Insights & Analysis: Market participants must prepare for the unexpected, ESAs say

Despite a broadly positive environment, ongoing geopolitical developments and economic uncertainties mean that financial market participants should be more vigilant than ever, according to...

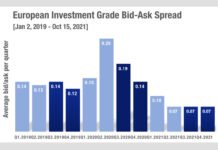

Seeing the pressure market makers are under in European credit

Secondary market data paints a picture of the challenges faced by sell-side market makers in the European corporate bond market during Q4. Information from...

AT1 trading volume was elevated a week ahead of Credit Suisse wipe-out

Trading in AT1 bonds spiked on Monday 20th March as a result of the Credit Suisse rescue at the weekend, with one platform trader...

PLSA: Absorbed research costs must not impede transparency for investors

By Flora McFarlane.

The majority of large asset managers are opting to absorb research costs rather than pass them onto clients, but investors must investigate...

Subscriber

On the Desk: Engineering better trading

Honing the trading function is an art; it requires an engineer’s eye for improving systems but a leader’s eye for putting the team first.

How...

European Women in Finance – Rebecca Healey – It’s not the destination but the...

Rebecca Healey talks to Lynn Strongin Dodds about Covid, Capital Markets and Career.

How do you see your role in the current crisis?

The initial question...

OpenDoor closes for business

OpenDoor, the trading venue for US Treasuries, has ceased trading, effective 13 January 2021.

In a statement posted online, Susan Estes, CEO and president of...

TD Securities becomes LCH SwapAgent member

TD Securities is now live as a LCH SwapAgent member, the first Canadian bank member, bringing membership up to 44 from across 12 countries.

The...

Adaptive Auto-X creates choice in trade automation

Developing automation to suit a range of market environments has put MarketAxess’s clients ahead in the drive for more efficient trade execution and adaptable...

David Fellah joins Broadridge

Expanding its AI and data division, Broadridge has appointed David Fellah as the firm’s first vice president of AI trading solutions. Based in New...

Research Profile: DirectBooks

The electronification of primary bond markets is a priority for buy-side firms this year, and DirectBooks, originally formed by a consortium of nine global...

Subscriber

Man Group reports profits down, AUM up

Alternative investment management firm, Man Group, has reported a 65% drop in profit before tax (PBT) in H1 2023 against the first half of...