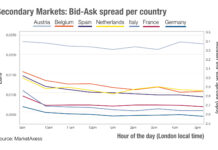

Chart of the week: Trading into Europe

Following our analysis of when to trade into US markets, we examine spreads for European rates markets across the day. For overseas traders working...

Eurex’s EU bonds futures go live

Eurex’s Euro-EU bond futures (FBEUs) are now available for trading.

The instruments, which were first announced in April, provide a physically deliverable futures contract designed...

Barclays hit by US$450 million loss on ETNs

Barclays has reported it has made an estimated loss of US$450 million on exchange-traded notes (ETNs). As the bank noted in a statement, ETNs...

Hanneke Smits appointed CEO of BNY Mellon Investment Management

Hanneke Smits, CEO of BNY Mellon subsidiary Newton Investment Management, is to be appointed CEO of BNY Mellon Investment Management, following the retirement of...

MUFG AM seeks operational efficiency with Bloomberg

Mitsubishi UFJ (MUFG) Asset Management has introduced Bloomberg’s BQuant Enterprise to its workflow in a bid to update its operational infrastructure.

Cloud-based analytics platform BQuant...

Jan-Hendrik Röske joins Ontario Teachers’ Pension Plan

Jan-Hendrik Röske has joined the Ontario Teachers’ Pension Plan (OTPP) as principal for developed markets rates and FX.

The pension plan holds CA$255.8 billion in...

The DESK’s Trading Intentions Survey 2020 : Tradeweb

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

Subscriber

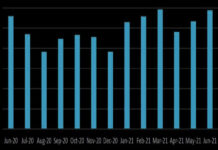

June sees European bond volume bounce back

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with...

MarketAxess executes first portfolio trade for tax-exempt munis

MarketAxess has executed the platform’s first ever portfolio trade for tax-exempt municipal bonds.

The portfolio trade was executed earlier this month between a large bank...

First quarter sees Tradeweb break US$1 trillion ADV

Market operator Tradeweb saw a US$1.06 trillion record average daily volume (ADV) for the first quarter of 2021, an increase of 18% compared to...

House of Representatives hearing: Volcker link to bond illiquidity tenuous

Testimony given to the US House of Representatives on 29 March 2017 suggests the Volcker Rule cannot be directly blamed for poor liquidity in...

Four drivers of Brazil’s increasingly complex corporate credit market

The Brazilian corporate credit market is becoming increasingly complex, and active bottom-up selection is essential for identifying winners and losers in this shifting environment.

That’s...