Tradeweb sees continued growth

Tradeweb has reported its average daily volume (ADV) in November was US$693 billion, an increase of 22% year-over-year, with continued broad-based growth in core...

Promotions at Fidelity and SSGA

James Lenton has been named head trader at Fidelity Investments in Hong Kong, where he has worked as a trader since 2017.

A spokesperson for...

The Agency Broker Hub : Covid-19 : Carmine Calamello

THE BROKERAGE DESK IN THE TIME OF COVID-19.

By Carmine Calamello, Head of Brokerage Desk, Intesa Sanpaolo – IMI Corporate & Investment Banking.

It was March 2020...

Investor Demand: Investors seek and reward customised asset management

Half of institutional investors favour managers who offer them more customisation, a recent Coalition Greenwich report has found – leading to additional mandates and...

Trading Intentions Survey 2017: US Focus

Firms with US credit desks are checking out Algomi, KCG Bondpoint and Trumid.

About the survey: The Trading Intentions Survey is conducted by The DESK, asking...

Subscriber

Redburn sees value in bond market venue M&A

Analysis by broker Redburn has found that major exchanges – in which it included MarketAxess, the fixed income trading venue, and interdealer broker TP...

Exclusive: Bloomberg’s New Issues Feed takes small, important step towards improving bond issuance

Bloomberg has launched a real-time feed, called the ‘New Issues Feed’, to provide clients with access to standardised information on new issues earlier in...

MarketAxess Q2 update: Claims 20% share global credit trading; portfolio trading ‘flattened out’

MarketAxess has reported its Q2 results for 2022, including a record composite corporate bond market share, estimated at estimated 20.2%, up from 17.8% in Q1 2021...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

US corporate bond market growth continues upward trend in July

The US corporate bond market in July saw increases across nearly all the metrics tracked by Coalition Greenwich, with average daily notional volume (ADNV)...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

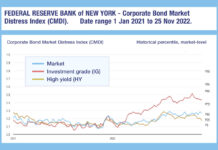

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...