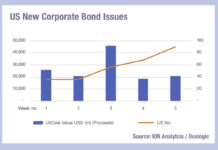

The big issue

Corporate bond issuance has boomed at the start of 2024, at a point when rates are peaking. They may not be that high in...

PGIM: Research indicates liquidity event is tail risk with greatest impact

In a survey of 400 senior investment decision-makers at institutional investors in Australia, China, Germany, Japan, the UK and the US with a combined...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...

SEC creates unit to tackle emerging risks

The Securities and Exchange Commission has created the Event and Emerging Risks Examination Team (EERT) in the Office of Compliance Inspections and Examinations (OCIE)....

Goldman net revenues for Q3 2023 driven by ‘strong performances’ in fixed income and...

Goldman Sachs saw its net revenues for Q3 2023 remain largely the same as Q2 2023 – US$11.82 billion – thanks in part to...

Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

TS Imagine launches cross-asset investment and trading platform for hedge funds

TS Imagine the trading, portfolio, and risk management platform provider, has launched TS One, a cross-asset class, software-as-a-service (SaaS) platform, designed for investing...

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

EWIFA Winners: Team players

Bloomberg’s Paula Fry, Global Head of Fixed Income and FX Trading Liquidity and winner of Excellence in Leadership, with Katharine Furber, Global Head of...

TS Imagine reports growth in volumes and user base for fixed income

TS Imagine, the cross-asset provider of trading, portfolio, and risk management systems reports it has seen average notional volume increase sevenfold in its TradeSmart...

Michelle Neal leaves New York Fed for private sector

Michelle Neal is leaving the Federal Reserve Bank of New York, effective March 2025, for payment systems developer Fnality.

Neal has been an executive vice...

Citi’s Peneety swaps to Citadel Securities

Citi veteran Vincent Peneety has jumped ship to Citadel Securities.

Based in New York, Peneety has joined the investment grade credit sales team at the...