Corporate bond issuance has boomed at the start of 2024, at a point when rates are peaking. They may not be that high in historical terms, but MarketAxess observed that new issues made up 15% of trading in the market, from an average of 8%.

With rates now on hold as central banks seek to put the final nail in the coffin of inflation, deals are delivering a sizable buying opportunity for buy-side firms.

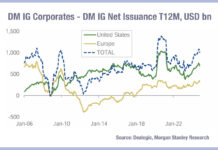

However, distribution of new deals is not evenly distributed around the globe, and for firms buying firmly in the investment grade space, which make up the majority of bond buyers, certain markets are playing an outsized role in deal making.

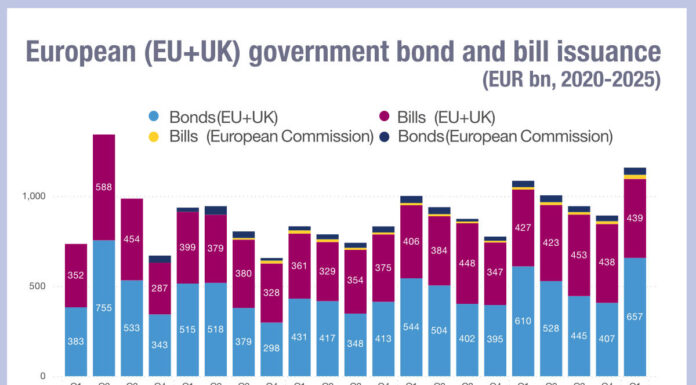

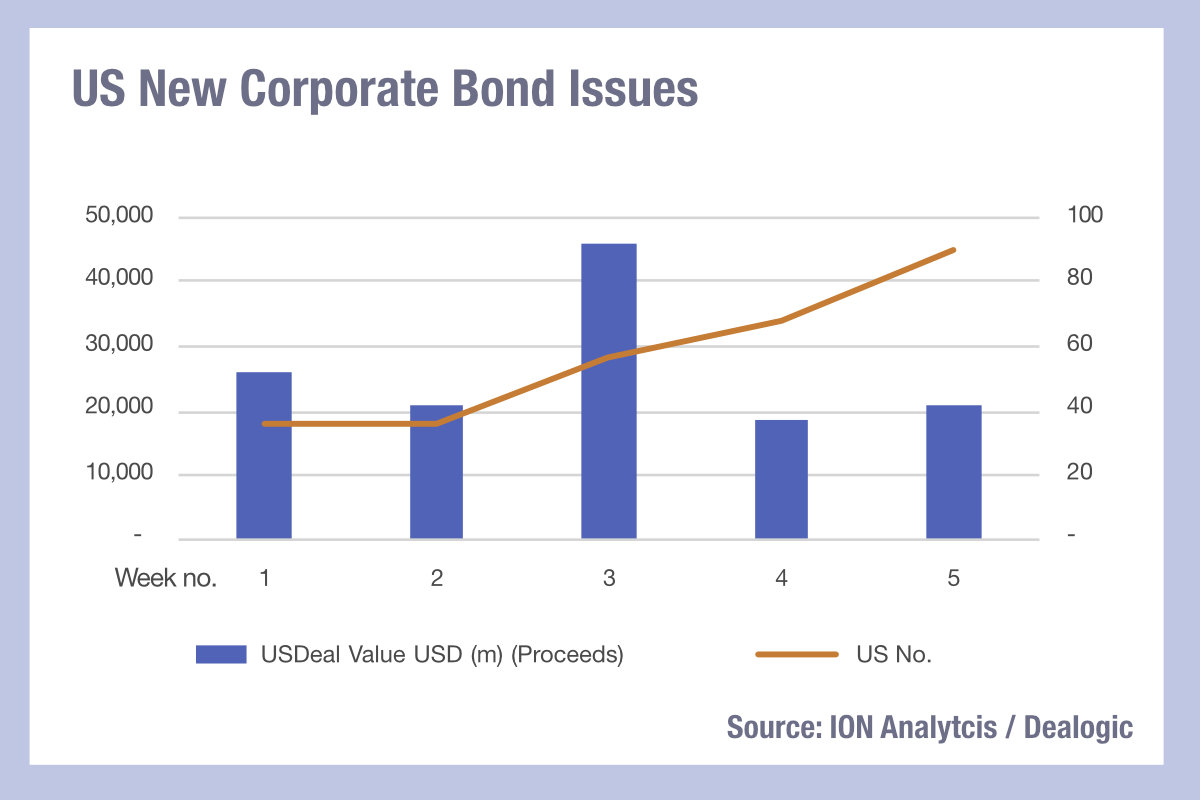

In January the US saw the greatest issuance with a total of US$81.52 billion according to data from Dealogic. Notional value of investment grade credit peaked in the third week of the year., with US$46 billion bonds issued, yet the number of deals kept climbing, and hit 90 by week five.

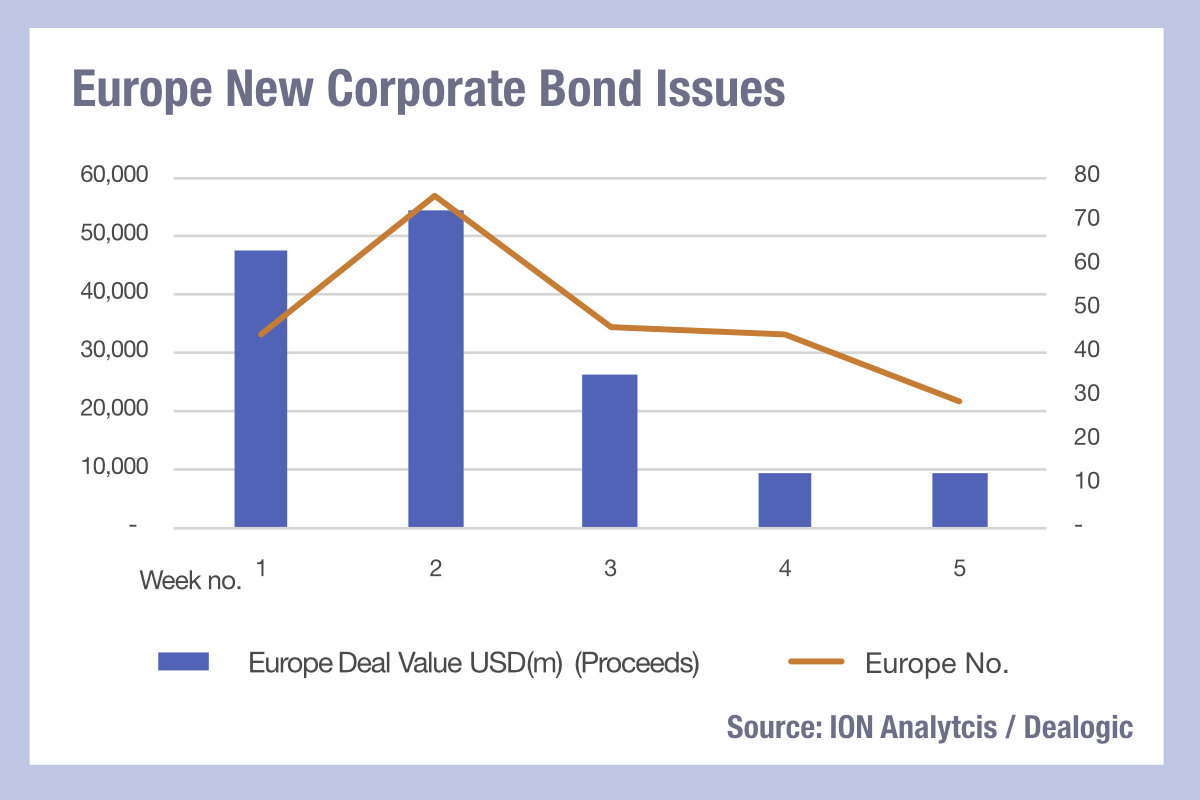

European IG peaked earlier, with US$147 billion in total issued by Week 5, eclipsing US deal value which hit US$133 billion by the same point in the year. Yet Europe saw the number of deals decline from Week 2 onwards.

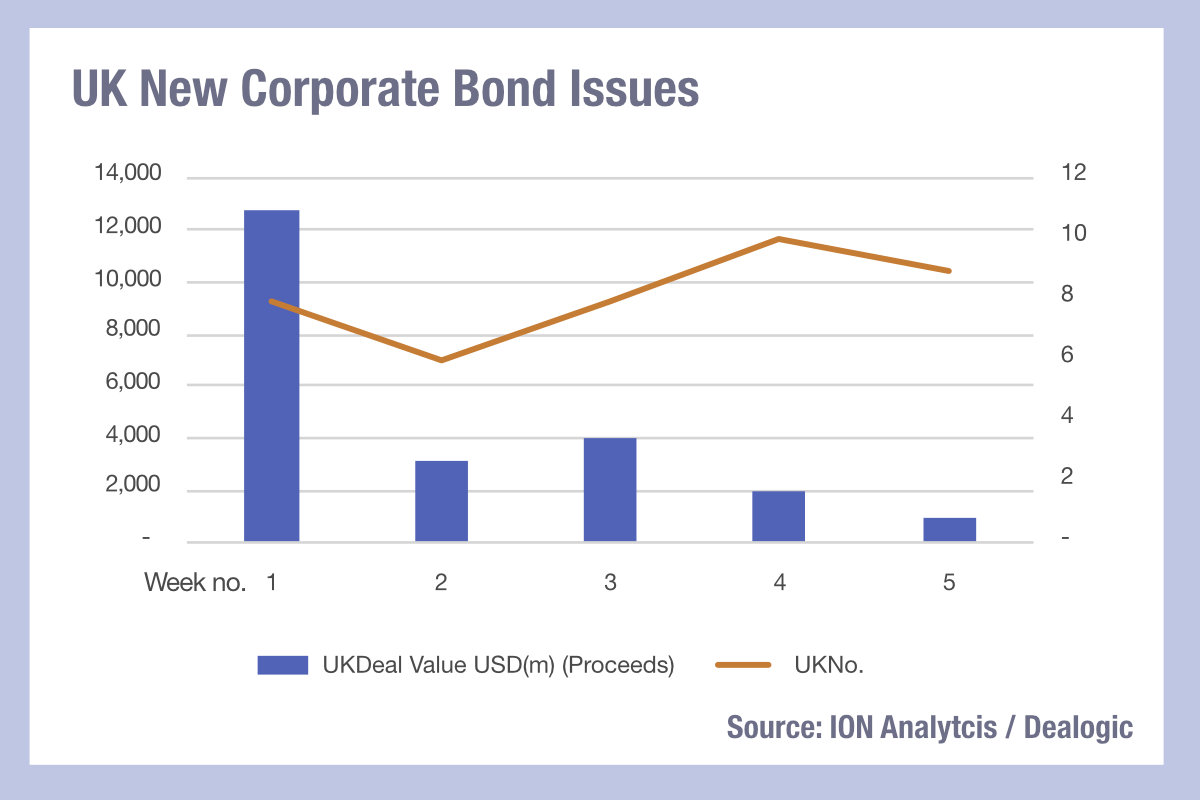

The UK saw a more modest US$22 billion issued by Week 5, more than half of which was delivered in Week 1.

These valuable opportunities can be challenging for trading desks to manage as there is limited ability to add value in new issuance and there is increasing discomfort about the level of manual phone and messaging being used to transmit information, given the investments made in primary market technology.

It may prove that 2024 is the crunch time for some tech platforms, with buy-side traders observing that a lack of dealer activity on them makes the hype less than useful. Assuming that issuance continues upwards, and noting that May 2023 was a bigger month than February 24, it is likely that operational pressure will force the buy side to up the ante.

©Markets Media Europe 2024

©Markets Media Europe 2025