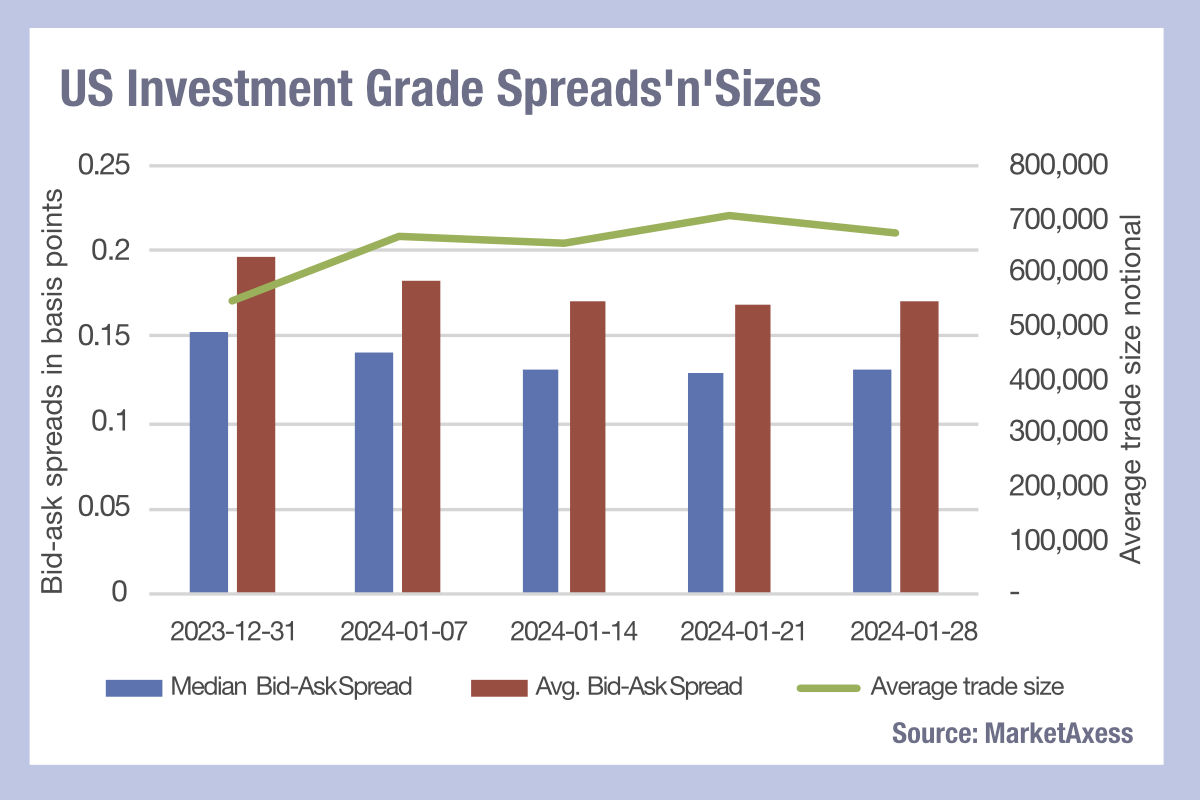

Credit markets have largely seen tightening bid-ask spreads since the start of the year on both sides of the Atlantic – some segments more than others – while average trade sizes have largely increased, according to data from MarketAxess. This suggests a net positive gain for bond market liquidity making it cheaper to trade larger sizes.

Starting with US investment grade, where the trade count rose 50% from 343,064 orders in the week beginning 31 January to hit 514,276 in the week of 28 January, while the average trade size rose 24% from US$547,551 to US$677,223 over the same period, while the median bid-ask spread fell 14%.

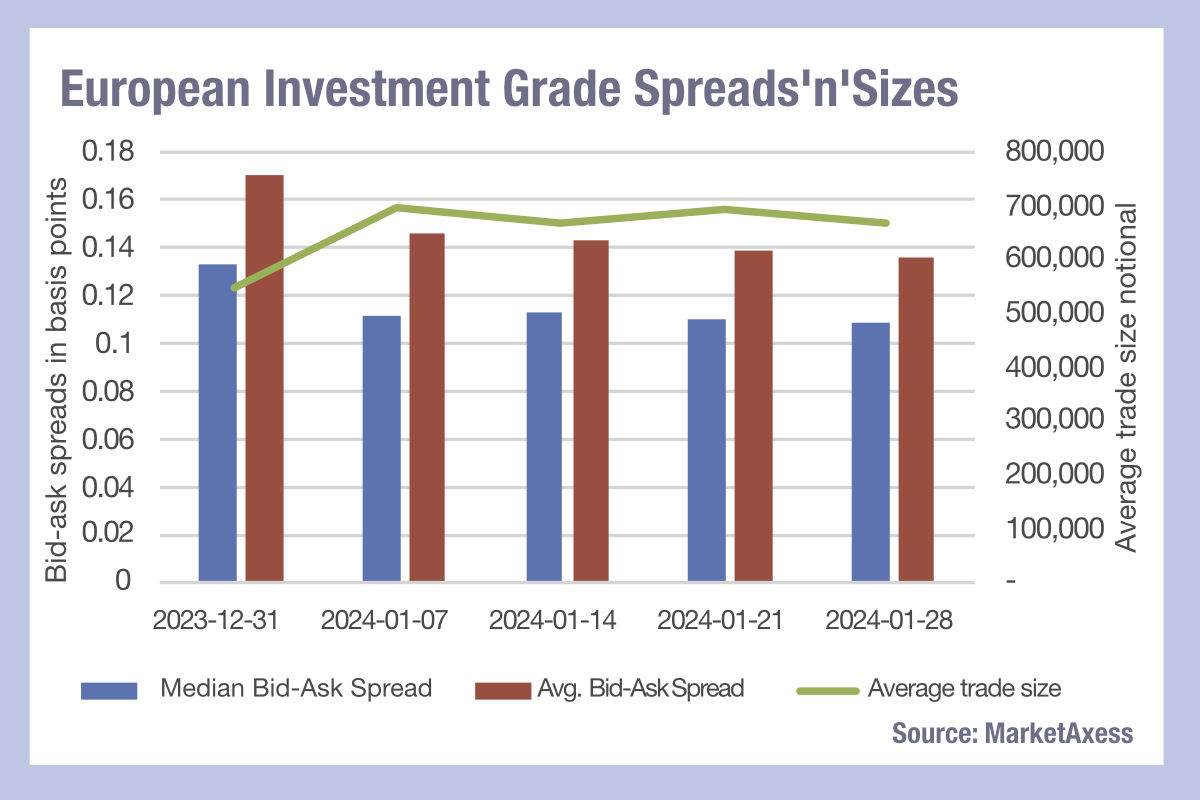

European investment grade saw a very similar trend. Trade count based on MarketAxess Trax data, which measures actiity across multiple markets, rose 86% from 42,213 in the first week of the year, to 78,390 by the week starting 28 January. Average trade size was up 22% reached €669,418 up from €547,850 at the start of 2024. Median bid-ask spread fell 18%.

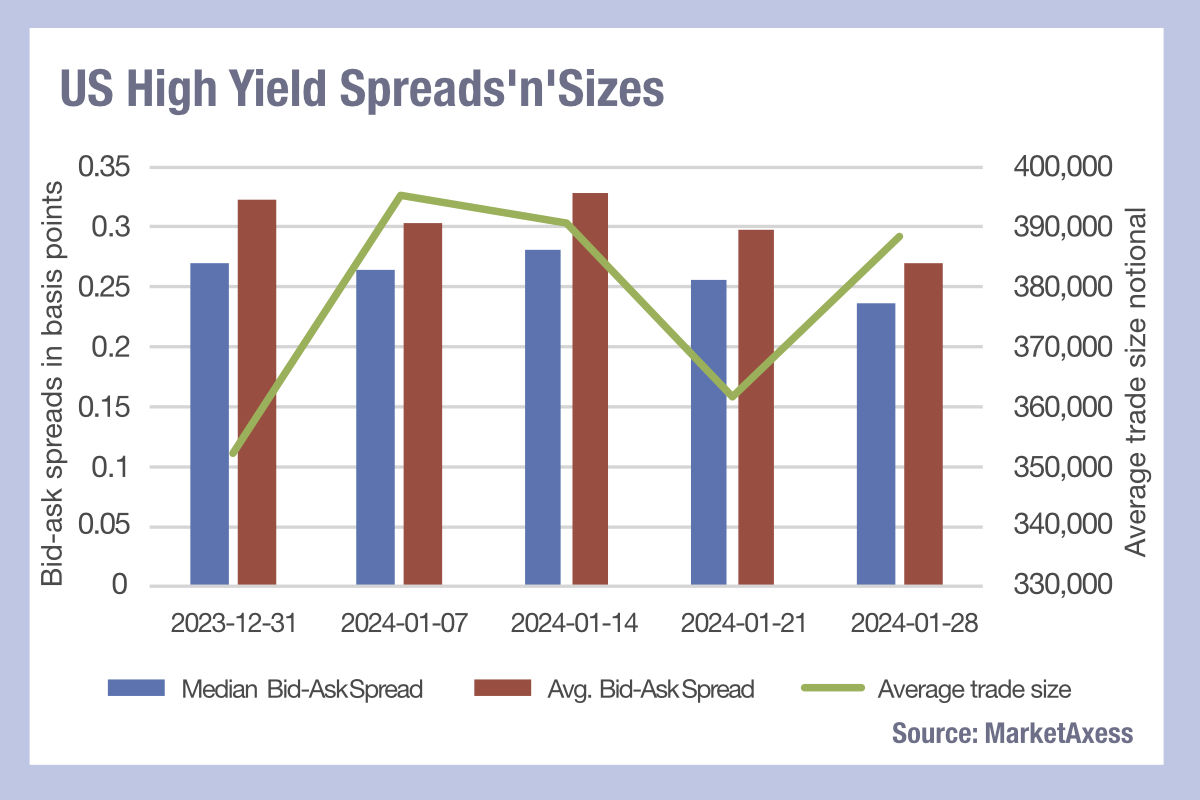

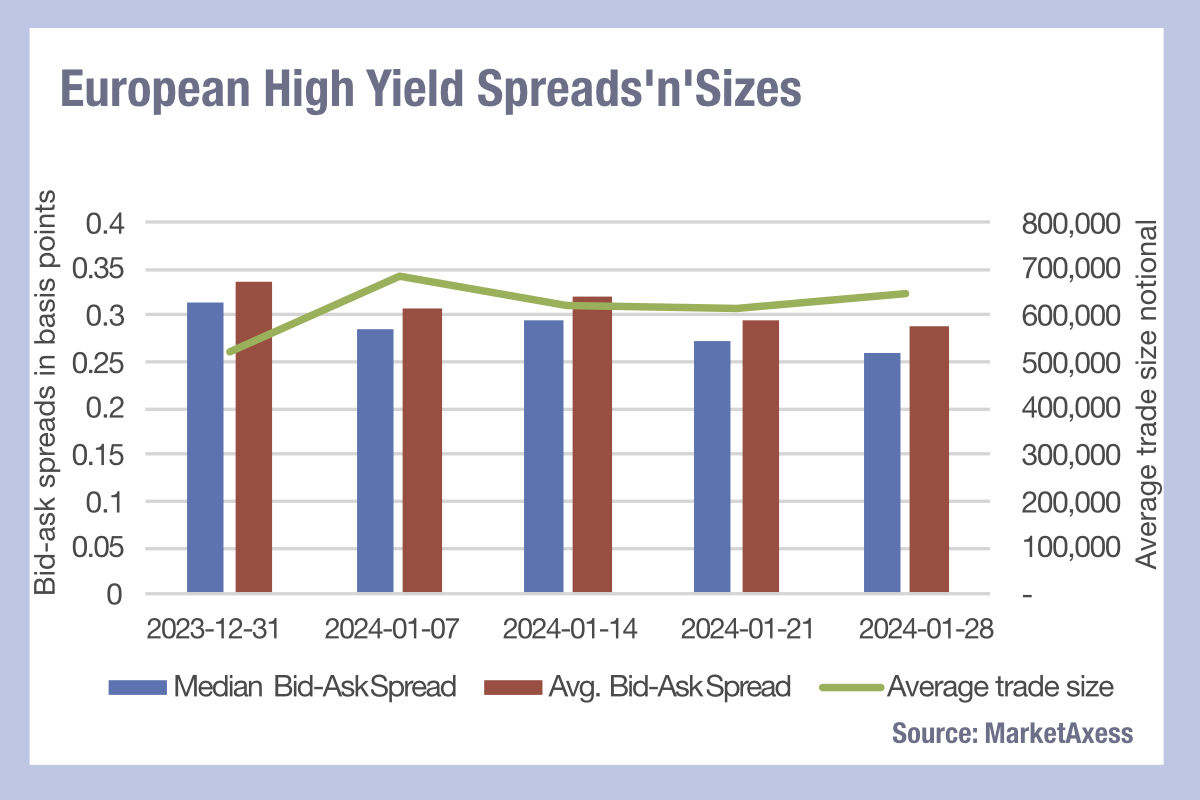

In high yield, similarly large shifts were seen. Trade count on TRACE for US high yield increased 47% over the first month, hitting 79,990 by the final week, while average trade size increased 10% to reach US$388,201. Median bid-ask spared fell 16%, but also saw the greatest level of volatility in credit markets, seesawing up and down during the month. This may well be in part due to the small relative sizes on US HY trades – at points half the size of IG trades in North America, while European HY and IG trade at a similar average size, although they have a marked difference in trade count and notional between the two ratings groups.

European HY saw trade count increase 59% by the end of January, to 13356, while average trade size grew 25% to €648,243 and median bid ask spread fell 17% to 0.26 bps.

While issuance of new bonds has clearly provided much liquidity into the market, these figures suggest that secondary market activity is moving very much in favour of buy-side trading desks during early part of 2024.

©Markets Media Europe 2024