Tradeweb’s access to Bond Connect: A game changer for electronic trading in Asia

When you open up a market to a broader range of customers, you need to ensure the infrastructure is robust and efficient, with new...

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...

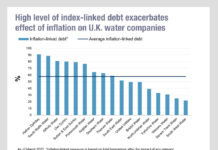

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

Subscriber

AFME and IA agree on UK consolidated bond tape

The Association for Financial Markets in Europe (AFME) has reached an agreement with the Investment Association (IA) on a proposal for a future UK...

July 2023: Tradeweb sees total credit ADV jump 30% YoY in July driven by...

At Tradeweb, in July 2023, fully electronic US credit ADV was up 34.8% YoY to US$4.8 billion and European credit ADV was up 38.6%...

Proprietary trading firms seek fixed income investment expansion in year ahead

Proprietary trading firms, buoyed by an optimistic outlook for the year ahead, are investing in trading new asset classes, particularly fixed income, with government...

Subscriber

Hidden regulatory risk in CSDR

An apparently back-office focused rule, the Central Securities Depositories Regulation (CSDR), could have a serious impact on bond market liquidity, when it comes into...

Industry viewpoint: New strategies for corporate bond index futures in 2023

David Litchfield, director for derivatives sales at Cboe Global Markets, explains how Cboe corporate bond index futures are supporting traders in a highly changeable environment.

The...

David Nicol appointed at GLMX

GLMX has appointed David Nicol as head of commercial operations. He has been a consultant at the firm since December 2023.

Nicol has more than...

AFME welcomes political agreement over CSDR mandatory buy-in

The Association for Financial Markets in Europe (AFME) has welcomed political agreement regarding the European Union's refit of the Central Securities Depositories Regulation (CSDR)....

Voice trading remains prevalent in Treasury trading

Citadel Securities is conducting a third of its Treasury risk by voice, according to a representative. Kevin McPartland, head of research, market structure and...

Berry named global head of trading at Refinitiv

Dean Berry has joined data and benchmarking giant Refinitiv as global head of trading. Berry was most recently the global head of electronic and...