What to do when credit goes quiet…

The low volumes in credit trading over summer created an opportunity for traders to engage in strategic projects that deliver longer-term benefits to the...

Tradeweb files for IPO

Market operator Tradeweb Markets, has filed a registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a proposed initial public...

Same trading costs, different year

The new year has seen trading volumes drop back to a similar level as seen in early January 2022, but in European credit, bid-ask...

Origination: Mars issues US$26 billion to acquire Kellanova

Mars Inc has issued US$26 billion in senior notes in a private transaction to fund its acquisition of snacking company Kellanova, formerly Kellogg’s.

The offering...

Italian lessons

Futures market and dealer engagement were both concerns during this year’s volatility, reports Dan Barnes.

The tension between Italy’s government and the European Commission has...

Adroit Trading Technologies names Michael Kraines chief growth officer

Adroit Trading Technologies, a buy-side execution management system (EMS) provider in fixed-income cash and derivatives, has named Michael Kraines the firm’s first-ever chief growth...

Diligent and S&P Global Market Intelligence launch insights reporting service

Governance, risk and compliance software firm Diligent has partnered with S&P Global Market Intelligence to launch Diligent Market Insights Reporting.

The service provides reports on...

Overbond and IPC partner on voice-to-AI supporting bond trading automation

Overbond has partnered with IPC, the communications and cloud connectivity service provider, to integrate IPC’s point-of-trade voice transaction data into Overbond’s artificial intelligence (AI)...

The barbell effect of analogue and digital trading

Buy-side firms were able to express their trading ideas into the market effectively during market volatility in April demonstrating that flexibility of communication and...

Fixed income platforms buoyed as all-to-all expands

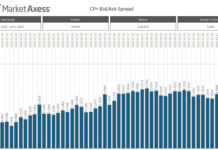

Fixed income electronic trading platform operators have announced record trading volumes in the first quarter of 2017.

MarketAxess, platform operator for dealer-to-client and all-to-all trading...

Credit Spotlight: How clear can pre-trade get?

Pre-trade transparency is a nirvana for over-the-counter markets, particularly corporate bond trading, which lack the publicly displayed prices of the exchange-traded market.

Unless it...

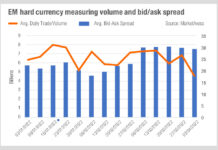

The cost of liquidity in EM today

A very graphic representation of the cost of liquidity can be seen in the latest data from MarketAxess. It shows that average daily volume...