Portfolio trading challenged on best execution

For decades, tourists have flocked to Spain’s Costa Brava in anticipation of the three Ss, broadly understood to refer to sun, sea and sangria....

Making the impossible, possible

Confidence in pricing data supports entirely new ways of trading through multiple trading protocols.

The DESK caught up with Matthew Walters, head of product for...

Bloomberg to buy Broadway Technology in boost to rates trading

Bloomberg has entered into an agreement to acquire Broadway Technology, a fixed-income execution management system (EMS) provider. This acquisition will help Bloomberg to...

Seth Johnson joins LedgerEdge in senior advisory role

Bond-trading platform, LedgerEdge, has appointed Seth Johnson to the firm as a senior advisor. Johnson will focus on commercial plan and growth, including business...

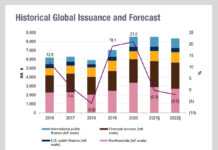

2022: Big primary, smaller secondary?

Despite the expectation of rising rates across markets, S&P Global Ratings Research are predicting that issuance of new bonds across markets will not see...

GSAM outsources global trade execution to BNY Mellon

Goldman Sachs Asset Management (GSAM) has selected BNY Mellon’s buy-side trading services for global trade execution.

BNY Mellon now provides global trade execution services to...

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

LTX launches BondGPT powered by OpenAI GPT-4

LTX, the market operator division of Broadridge Financial Solutions has launched BondGPT, an application powered by OpenAI GPT-4 that answers bond-related questions and assists...

MUFG AM seeks operational efficiency with Bloomberg

Mitsubishi UFJ (MUFG) Asset Management has introduced Bloomberg’s BQuant Enterprise to its workflow in a bid to update its operational infrastructure.

Cloud-based analytics platform BQuant...

Six New Trends in Managing Fixed Income Accounts

By Blake Lynch, Head of Sales at IMTC.

Predicting the bond market’s next move is difficult at best—will the yield curve steepen or flatten? Will...

IDX: The play for efficiency

Panellists at this year’s International Derivative Expo conference considered regulation, technology and competition as they discussed how the industry can improve efficiency and promote...