ADDX launches blockchain-based debt issuance marketplace

Private market exchange ADDX has launched a blockchain-based multi-issuer debt issuance solution for firms to issue digitised commercial paper and bonds.

The digitised bonds from...

Are interdealer markets dead?

So-called ‘interdealer’ markets have long been used by large buy-side firms. This well-known secret creates inequality for those investment firms barred from participating, and...

Colm Murtagh: The Long Goodbye

Dollar Swaps Markets Bid Farewell to LIBOR.

In July, it was linear swaps. In November, non-linear. And next week, on December 13, the further expansion...

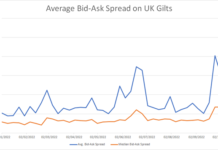

Barnes on Bonds: Secondary Gilt Trip

To look at the whipsaw effect of the UK’s 23 September mini-budget on secondary UK bond trading, we have taken data from MarketAxess TraX,...

Odd-lot bond case alleges pressure on Bloomberg and collusion

In the US Southern District Court of New York, a class-action lawsuit has been brought against a group of banks, alleging that since 1...

Henriques poached by HilltopSecurities

HilltopSecurities has named Drew Henriques co-head of High Yield Municipal Trading, having poached him from Citi. He had been a high yield municipal trader...

Tradeweb to acquire Nasdaq’s eSpeed central limit order book

Electronic bond market operator, Tradeweb, has agreed to buy Nasdaq’s US fixed income electronic trading platform. The Nasdaq interdealer platform, formerly known as eSpeed,...

EWIFA Crystal Ladder Winner: Amber Wright

European Women in Finance, Crystal Ladder winner Amber Wright, is Global Head of Fixed Income & E-Trading at RJ O’Brien and discusses maths, efficiency...

What will shape Europe’s bond market in 2025

The European bond market is under pressure from several dynamics which are shaping its evolution, with implications for investors and issuers.

Andy Hill, senior director...

SEC report on algo trading highlights lack of joint oversight

US markets regulator the Securities and Exchange Commission (SEC) has published a report to the US Congress on algorithmic trading in US debt and...

Neilly takes leadership role at Clearlake

Gordon Neilly has joined Clearlake Credit as head of credit for Europe. He is based in London.

Global investment firm Clearlake Credit finances North American...

Automating the fixed income workflow: data is king

Automated trading is fast becoming the new normal in the global fixed income markets. Once considered too complex and nuanced for automation compared with...