Chart of the week: Attack of the killer BBBs

The lowest tier of investment grade bonds show an interesting opportunity in the new issue space, as observed by analyst firm CreditSights. Relative value...

Pham replaces Behnam as CFTC chair

Caroline Pham has been named acting chairman of the Commodity Futures Trading Commission (CFTC), replacing Rostin Behnam.

Behnam announced his departure earlier this month, after...

This Week from Trader TV: Matt Howell, T. Rowe Price

ETF Innovations, 0DTE Options, and Fed uncertainty reshapes trading.

Thinned summer liquidity, surging ETF flows, and the growth of zero days to expiry (0DTE) options...

Me The Money Show – Episode Two

Terry Flanagan, editor of Markets Media, highlights previous winners of the Markets Choice Awards and gives tips on nominations for this year, with Dan...

Coalition Greenwich sees US bond trading volumes falling in Q2

A report by market analysis form Coalition Greenwich, part of S&P Global, has found that after an active first quarter, corporate bond trading slowed...

Doriane Geyler Rojas joins Ostrum AM

Doriane Geyler Rojas has been appointed business manager and project lead within the "direction des gestions" at Ostrum Asset Management.

Ostrum AM says it manages...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

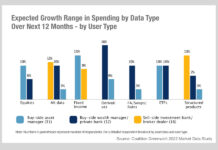

Coalition Greenwich: Buy-side data spend sees highest growth in fixed income

Spending is up across all categories of market data, with equities, fixed income and derivatives all expected to see a rise of more than...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

APEX:E3 new AI service ALICE codes equations found in reports, TCA and research papers

Technology and analytics provider, APEX:E3, has launched a new integrated AI service, ALICE, to allow buy-and sell-side firms to rapidly analyse large documents and...

TP ICAP completes Liquidnet acquisition

TP ICAP has finalised the acquisition of Liquidnet, which will enable the interdealer broker to tap into significant growth in dealer-to-client rates and credit...

CMSA – The drive to change industry dialogue in corporate bond markets

To create a wider dialogue around industry change, the Credit Market Structure Alliance (CMSA) is building an event with a democratic agenda.

The DESK: Why...