Could ‘Fortnite’ guide market evolution

Online game ‘Fortnite’, Netflix and Spotify will drive technological advances in e-trading, Steve Toland, founder of TransFICC, told delegates at the Fixed Income Leaders...

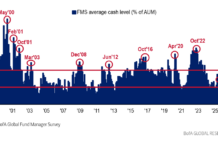

Investor Demand: BofA sees investor sentiment bounce back in May

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In...

Connectivity platforms report FI deals ahead of MiFID II

By Sobia Hamid.

The growth of electronic trading in fixed income is driving connectivity between trading platforms. In 2016, Greenwich Associates estimated electronic trading of...

Long-term investors lean into equities

While long-term equities allocations continue to rise, Noel Dixon, senior macro strategist at State Street Global Markets, noted that: “weakness among fixed income is...

ICE: Measuring and managing climate risk in debt markets

As the physical risks associated with climate rapidly shift, borrowers, lenders and investors need to better understand their exposure. Larry Lawrence, head of sustainable...

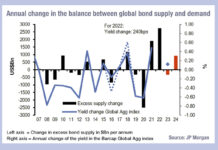

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

Overbond launches trade size-sensitive AI bond liquidity and pricing analytics

Overbond, the API-based credit trading automation and execution service, has launched artificial intelligence-driven liquidity and price confidence analytics, that are designed to auto-adapt to...

This Week from Trader TV: Stuart Lawrence, UBS Asset Management

UBS AM: Markets brace for the tariff volatility, and concerns develop over “irrational optimism”

While markets have been trading at all-time highs, Stuart Lawrence, head...

Profile : Paul Squires : Navigating uncharted territory

Paul Squires, Head of the EMEA Equities and Henley Fixed Interest dealing teams at investment management company Invesco discusses the benefit of experience, the...

Rules & Ratings: Securitisation reforms “stifling” for CLOs, LMA says

The Loan Market Association (LMA) has struck back at the Financial Stability Board’s (FSB) positive initial assessment of post-2008 securitisation reforms, stating that the...

Traders call time on outsized European market open hours

Buy- and sell-side traders have called for Europe to review its equity market open periods, which at eight and half hours is over 30%...

Jonathan Rick: SOFR First slowly, then all at once

SOFR First slowly, then all at once: Measuring the market transition from LIBOR

Jonathan Rick, Director of Research, Tradeweb

The dealer-to-dealer market’s switch towards the Secured Overnight...