Jefferies: Fixed income ETFs drive transformation of the market

The impact of exchange-traded funds (ETFs) on the fixed income market cannot be overstated, agreed speakers at Jefferies’ ‘New Investing Frontiers – Explore the...

Italian engineering

The longstanding debt market in Italy offers a good source of insight into the impact of changing rules around best execution and transparency in...

UBS: The client-led dealer driving best execution

Traditional sell-side firms can engage most effectively in fixed income by enabling, rather than pushing, buy-side strategy.

As markets face considerable operational pressure, delivering change...

Technology : How smart is dealer AI? : Dan Barnes

Can artificial intelligence boost broker-dealers’ client coverage?

Simple automation will not work for complex bond markets; tools that learn to find patterns are needed...

FILS in Barcelona: What will help traders best adapt to the new bond market?

Although the basic function of a trader – price and liquidity formation – has remained the same over the past two decades, the level...

Industry viewpoint : Accessing China’s bond market with HSBC

Outlining the market impact of the latest changes in the Chinese bond market, Tony Shaw, Head of Institutional Sales APAC at HSBC, discusses the...

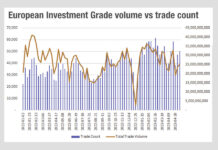

The implication of Europe’s falling volumes

An ominous sign in Europe’s secondary markets for dealers, as volumes remain in the doldrums.

Anecdotally, buy-side firms report volumes are up to 20%...

Bilateral electronic bond trading gains ground with UBS AM and JP Morgan’s FlexTrade connection

FlexTrade Systems, the execution and order management system (EOMS) provider has facilitated a direct electronic execution between UBS Asset Management and JP Morgan in...

BNY goes live with Dublin EU trading desk

BNY has established a trading desk in Dublin, supporting EU-based clients across global fixed income and equity markets. Bianca Gould, head of EMEA equities...

Understanding Portfolio Trading

Li Renn Tsai, Head of Products and Sales, Asia, at Tradeweb explains how Portfolio Trading can improve bulk trades of bonds by creating cost savings,...

Interactive Brokers expands global bond offering

Interactive Brokers, an automated global electronic broker, has expanded its global bond offering within the IBKR Bond Marketplace, with regards to liquidity and trading...

Under the hood of CBOE’s new US Treasury platform

Market and infrastructure operator, Cboe Global Markets, is planning to introduce a new dealer-to-dealer electronic trading platform for on-the-run US Treasuries called ‘Cboe Fixed...