Mosaic Smart Data expands into credit markets

Mosaic Smart Data, a capital markets data analytics provider, has expanded its data analytics platform to support a wide range of credit instruments, such...

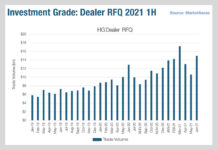

Dealer engagement in multi-dealer platforms is growing

Sell-side firms appear to be increasing their engagement with corporate bond trading platforms. The narrative of increased bilateral trading between dealers and clients...

Red, consolidated, tape

Traders want Europe to improve the quality of fixed income data, and quickly. Gill Wadsworth reports.

In October UK consultant Market Structure Partners was awarded...

New flexible data offerings – Eugene Grinberg

Eugene Grinberg, Solve Advisors Co-Founder and CEO, tells The DESK how the firm’s acquisition of Advantage Data and Best Credit Data will support better decision-making...

Cboe Credit Index Futures: The expanding liquidity picture

As buy-side firms look to increase their exposure to credit futures, market operators find ways to support access.

The DESK spoke with David Litchfield, director...

CSDR warning for EM bond liquidity

The mandatory buy-in regime that will be introduced next year by Europe’s Central Securities Depositories Regulation (CSDR) could have negative consequences in the less-liquid...

Flextrade and BlackRock platforms to integrate, extending OEMS consolidation trend

Execution management system (EMS) provider Flextrade and Aladdin, the order management system (OMS) developed by asset manager BlackRock, are to deepen their partnership, with...

Craig McLeod: Exploring the new frontiers of EM trading

Today’s EM traders need more data, market access and broader liquidity than ever before to meet the investment profiles of their portfolios. Craig McLeod,...

Primary markets: The choices facing buy-side traders

Ted Douglas, Co-Head of Global Fixed Income, Capital Formation at IHS Markit spoke to The DESK about the dynamics of bond issuance for the...

Mosaic Smart Data appoints Oxford Professor as Scientific Advisor

Rama Cont, Professor of Mathematical Finance, joins as Scientific Advisor

London, June 2019: Mosaic Smart Data (Mosaic), the real-time capital markets data analytics company, has...

Tradeweb’s annual client letter – in full

The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough...

ESMA’s DLT regime could go permanent, despite low takeup

The European Securities and Markets Association (ESMA) has outlined potential amendments to make its distributed ledger technology (DLT) pilot regime permanent, despite a lacklustre...