How a partnership led by innovation is helping benefit investors

Tradeweb and Generali Investments have worked carefully to engineer maximum change with minimal risk to better support the asset manager’s clients.

Enrico Bruni, head of Europe...

European Women in Finance 2022 – The Longlist

In 2020, Best Execution and The DESK hosted the first European Women in Finance Awards, following the model of Markets Media's long-established awards programme....

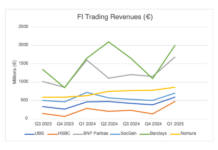

Barclays bounces with strong Q1 trading revenues

Fixed income trading revenues spiked in the first three months of the year at Barclays, putting the bank significantly ahead of the majority with...

Vieira leads ASA credit

Eduardo Vieira has joined asset management firm ASA Investments as head of credit and portfolio management. He is based in New York.

ASA is a...

Fixed income trading : Refinitiv

A look at current market challenges and the leading-edge tools that can mean the difference between success and failure. By Alexandre Hardouin, Refinitiv

Trusted data is...

Nominate now for the European Markets Choice Awards 2023

To gain real recognition in the front office, put your best foot forward with a nomination in the European Markets Choice Awards 2023.

Recognising excellence...

On The Desk: Carl James: On changing trader culture

Moving to a data-led model of trading requires a change in culture across the desk, as Pictet Asset Management’s head of Fixed Income Trading...

CME Group launches price comparison tool for cash US Treasuries and futures

Derivatives market operator, CME Group, has launched UST Market Profile, a tool to bring together listed Treasury futures and BrokerTec cash treasuries in one...

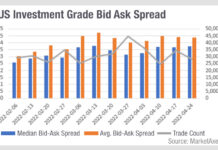

Is US investment grade market-making starting to fray?

In US credit, mean bid/ask spreads are skewing upwards from the median, indicating that a greater proportion of larger spreads are in some cases...

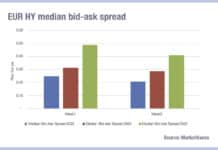

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...

European Women in Finance : Alexandra Boyle : Making a noise

Alexandra Boyle, Head of Client Strategic Group at OpenFin, speaks to Markets Media’s senior writer Shanny Basar about her career, her philosophy and her...

One desk for multi-asset low-touch trading

If a single desk can trade all liquid instruments for an asset manager, it could see significant cost and process efficiencies. Lynn Strongin Dodds...