This Week from Trader TV: Alex Morris, CIO, F/m Investments

F/m Investments CIO urges diversification amid US political gridlock and AI boom

New Trader TV This Week - Political dysfunction in Washington and the ongoing...

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

Bloomberg beefs up communications with cross-firm chatbots

Bloomberg has launched cross-firm chatbots on its Instant Bloomberg (IB) platform, aiming to ease workflow disruptions and prioritise value-add communications.

The new product brings Bloomberg...

This Week from Trader TV: Gregory Corrigan, L&G Asset Management

L&G AM: Record volumes, retail surge, and new venues shape US equity markets.

This year, US equity markets have been shaped by record trading volumes,...

IA opens best ex debate

by Dan Barnes.

The risks of pushing for quantitative execution analysis, when too little data exists to support it, have been revealed in a whitepaper...

FILS 2022: Big themes this year

The innovation day at the Fixed Income Leaders Summits (FILS) on Tuesday is held under the Chatham House rule preventing direct reporting of what...

Trian, General Catalyst launch $7bn bid to take Janus Henderson private

Trian Fund Management and General Catalyst Group have submitted a joint proposal to acquire Janus Henderson Group, taking the UK asset manager private.

Known for...

Coalition Greenwich: Dealers holding long-dated bonds again; net Treasury positions double

Dealers are holding positive levels of longer-dated corporate bonds in their inventories again, and treasury bills drove volume growth in H1 2023, according to...

Liquidnet signs up to the Sustainable Trading initiative

Market operator Liquidnet, part of the TP ICAP Group, has joined a member of Sustainable Trading, a non-profit membership network dedicated to supporting environmental, social...

Viewpoint: Technology and the evolution of fixed income trading

Steve Toland, co-founder TransFICC

The fixed income and derivatives market is evolving, rapidly migrating away from the phone onto electronic venues. Electronic trading satisfies the...

SEC appoints six new Investor Advisory Committee members

The US Securities and Exchange Commission (SEC) has added six new members to its Investor Advisory Committee.

The new members, who will serve four-year terms,...

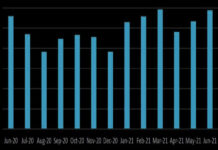

June sees European bond volume bounce back

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with...