This Week from Trader TV: Stuart Lawrence, UBS Asset Management

UBS AM: Markets brace for the tariff volatility, and concerns develop over “irrational optimism”

While markets have been trading at all-time highs, Stuart Lawrence, head...

Trading protocols: The pros and cons of getting a two-way price in fixed income

Getting a two-way price is unusual in fixed income trading, but normal in FX; that is changing and yielding some real results for best...

Ratings & Analysis: Fitch: US bank regulators converging with “informal alignments”

Executive actions have accelerated regulatory consolidation and centralisation between federal US bank regulators, according to Fitch Ratings.

These informal alignments, driven by executive orders rather...

Negotiations begin on MiFIR/MiFID final review and consolidated tape

EU member states’ representatives have today agreed a mandate for negotiations with the European Parliament on the proposed regulation reviewing the Markets in Financial Instruments...

AFME and IA agree on UK consolidated bond tape

The Association for Financial Markets in Europe (AFME) has reached an agreement with the Investment Association (IA) on a proposal for a future UK...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Former TD Securities head of US Treasury trading indicted for alleged spoofing

A federal grand jury in the US has returned an indictment charging Jeyakumar ‘Jack’ Nadarajah, formerly TD Securities’ head of US Treasury trading, with...

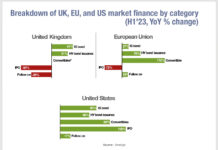

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

MarketAxess executes first portfolio trade for tax-exempt munis

MarketAxess has executed the platform’s first ever portfolio trade for tax-exempt municipal bonds.

The portfolio trade was executed earlier this month between a large bank...

Credit Market Structure Alliance conference fights to bypass commercial debate

Now in its second year, the CMSA conference fights for the right to maintain integrity on stage.

ViableMkts is hosting the next installment of the...

Industry bodies rail against new US capital rules

Trade bodies have set their stalls against the introduction of planned capital rules in the US, which would create additional costs for banks seeking...