BlueCrest poaches Sam Tabari from Goldman

BlueCrest Capital Management has hired former Goldman Sachs rates trader Sam Tabari as a senior portfolio manager on its London-based global-macro desk.

He will run...

ISIN at issuance launched for Eurobonds by Origin

Origin Markets, the debt capital markets fintech, is launching an instant-ISIN feature, created in collaboration with international central securities depositary (ICSD) Clearstream, which is...

Diligent and S&P Global Market Intelligence launch insights reporting service

Governance, risk and compliance software firm Diligent has partnered with S&P Global Market Intelligence to launch Diligent Market Insights Reporting.

The service provides reports on...

Harrington joins Columbia Threadneedle

Marc Harrington has been appointed as senior fixed income trader at Columbia Threadneedle Investments. Harrington’s carrier as a buy-side bond trader, last saw him...

Ediphy’s virtual data manager harmonises fixed income data for easy consumption

Fixed income execution and analytics services provider Ediphy has unveiled a new cloud-based data management as a service offering. The DESK speaks to CEO...

Liquidnet Credit revenue hits £11 million, splits from Liquidnet Equities

Liquidnet Credit, part of interdealer broker, data and services provider TP ICAP, saw revenues grew to £11 million in 2023 according to a spokesperson...

Liquidnet releases future rolls workflow service

Liquidnet has launched Roll Seeker, a tool to improve workflows associated with the execution of futures rolls.

Roll Seeker will enable the bilateral negotiation of...

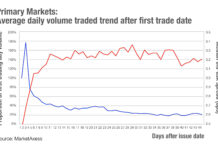

Chart of the week: Get in early

Access to primary bond markets has been a headline topic for buy-side traders over the last four years. As issuance volumes have grown, rising...

On The Desk: Christine Kenny : Loomis Sayles

KNOWLEDGE AS AN ASSET (FROM DESK TO MANAGEMENT).

Christine Kenny, managing director, senior fixed income strategist, compliance officer and head of the London office at Loomis, Sayles...

Wellington targets US wealth clients with interval fund

Responding to growing interest in alternative solutions, Wellington Management has launched its first interval fund.

Through the Wellington Global Multi-Strategy Fund, Wellington aims to provide...

Strategically automate and allocate to survive

There is a lot to be afraid of in the modern world. Geopolitical shocks, inflation and black swans abound, and the old ways do...

Debt deals decline

Debt markets have seen a year-on-year (YoY) decline in deal activity in 2025, according to data from Dealogic, reflecting the pensive mood amongst corporations...