Institutional sales trader veteran James Williams moves to Tourmaline Europe

Institutional sales trader veteran James Williams has been made managing director of outsourced trading solutions firm Tourmaline Europe, based out of London.

Williams has spent...

KfW issues first digital Euro commercial paper via Onbrane

Bond issuance platform, Onbrane, has onboarded KfW, the national development bank of Germany, and processed the first KfW's first Euro commercial paper via Onbrane’s...

Barclays Japan appoints JP Morgan veteran

Yoichi Takemura has been appointed head of macro trading for Japan at Barclays. He will be based in Tokyo.

Alongside overseeing the macro trading division,...

Virtu data scientist jumps to Vanguard

Vanguard has appointed Erin Stanton as a senior manager and investment management product manager. She is based in Pennsylvania.

The company holds US$10.4 trillion in...

BlackRock loses senior market structure team as Winnike departs

BlackRock has lost its second senior market structure specialist in a few weeks as Michael Winnike, director, market structure at BlackRock, left the firm...

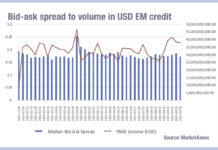

What’s up EM?

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...

ECB corporate bond programme winding down?

ECB corporate bond programme winding down?

Deutsche Bank analysts have noted indications that the European Central Bank (ECB) is winding down its Corporate Sector Purchase...

UPDATE: Fed to end supplementary leverage ratio, talks down tapering

The federal bank regulatory agencies today announced that the temporary change to the supplementary leverage ratio, or SLR, for depository institutions issued on 2020,...

Bond pricing battle shutters Nordic funds

Several Nordic fund managers have been shuttering fixed income funds, mainly in the corporate bond space, to allow them to get prices from banks...

FILS US 2023: Traders need tech solutions that plug directly into their workflow

The View on Liquidity panel at FILS US 2023 had some stern words on the urgent need to integrate better protocols directly into workflows...

EM debt funds on a winning streak for inflows

According to Morgan Stanley analysis, emerging market (EM) debt funds have seen eight weeks of inflows over the summer period, representing the longest streak...

Smart deployment of tech is key to boost FI desk effectiveness

Mehmet Mazi, Managing Director and Head of Credit Trading at HSBC, gives his expert insight into optimising the trading desk.

Where are the greatest risks...