SIX acquires majority stake in fixed income data firm FactEntry

SIX has acquired a majority stake in FactEntry, a global provider of fixed income reference data, analytics, and solutions for financial market participants.

The acquisition,...

Investor Appetite: Dutch pension move to DC triggers increased hedge rate ratios

Pension funds are preparing to move to a defined contribution model in the Netherlands, ahead of a mandatory switch on 1 January 2028. They...

TS Imagine launches cross-asset investment and trading platform for hedge funds

TS Imagine the trading, portfolio, and risk management platform provider, has launched TS One, a cross-asset class, software-as-a-service (SaaS) platform, designed for investing...

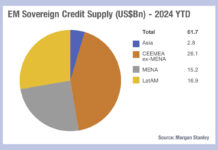

Morgan Stanley: EM issuance in 2024 to outstrip 2023

Assessment from Morgan Stanley has found sovereign hard currency gross issuance is likely to increase to US$164 billion in 2024 due to more open...

On The Desk: Christoph Hock: On building efficiency

Union Investment’s development of a multi-asset trading team and segregation of high and low touch business is allowing it to focus trading resource where...

Primary concern : FIXing issuance

Efforts are underway to automate debt offerings and give the buy side greater control. Lynn Strongin Dodds reports.

Initial public and debt offerings can be...

MiFIR: Controversy around consolidated tape proposal for revenue sharing with venues

The Czechia presidency of the Council of the European Union proposed amending the Markets in Financial Instrument Regulation (MiFIR) on 16 December 2022, with...

This Week from Trader TV: Sven Rudolf, ODDO BHF Asset Management

Market calls for better liquidity in credit futures and execution transparency in bilateral trading

Speaking at the Fixed Income Leader's Summit (Worldwide Business Research (WBR)...

Surprise at inaccurate US election poll predictions has increased volatility

With a victory for either side being far from clear in the US election, investment commentators have warned of sustained volatility across asset classes....

Primary ignition – at both ends

Politics are being side lined in the battle for efficiency in primary markets for buyers, and for issuers.

The top operational priority for buy-side, and...

Ba leads multi-asset trading at Banque de Luxembourg

Abdoulaye Ba has been promoted to head of multi-asset trading at Banque de Luxembourg.

He replaces Quentin Gaget, who has held the role since 2023.

Banque...

Insights & Analysis: Risk appetite rises as market stability risks fall, BofA says

An increasing number of investors are taking higher risks relative to their benchmarks, according to Bank of America’s February Global Fund Manager Survey.

The net...