Trading: Best practices for the sell-side desk

Buy-side traders do not have time to waste, so attention is key to a strong relationship.

We asked buy-side desks about the best ways their...

Risk appetite increasing as investor confidence rises 5.1 Points in August

State Street Global Markets has released the results of the State Street Investor Confidence Index (ICI) for August 2022.

The Global Investor Confidence Index increased...

NBIM names global co-heads of fixed income trading

Norges Bank Investment Management (NBIM) has appointed Pauli Mortenson and John Sullivan as global co-heads of fixed income trading, following the promotion of Malin...

Katana launches on Bloomberg

Katana, the pre-trade analytics tool that helps to identify relative value opportunities for bond market dealers and asset managers, is live on the Bloomberg...

Duffy remains confident in face of FMX challenge

Despite record results, one topic dominated CME’s Q2 earnings call earlier this week: FMX.

CEO Terry Duffy has been vocal from the outset about his...

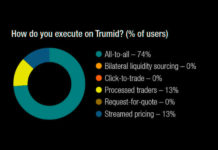

The DESK’s Trading Intentions Survey 2020 : Trumid

TRUMID

Trumid has experienced astounding growth over the past year, with average daily trading volume in January up 325% over January 2019, reaching US$761m, which...

Subscriber

Technology : Trader engagement : Dan Barnes

Helping traders to think like engineers

The gap between the technology a trading team wants and the technology it gets is often wide; helping them...

bondIT: Elevated global risk of credit re-ratings

bondIT, a provider of credit analytics and next-generation investment technology, has published its quarterly credit risk forecast, indicating an elevated credit risk across the...

Surprise at inaccurate US election poll predictions has increased volatility

With a victory for either side being far from clear in the US election, investment commentators have warned of sustained volatility across asset classes....

Trade munis like a champion.

To kickoff Muni Madness, MarketAxess are unveiling their latest White Paper that details the methodology behind this revolutionary pricing tool that brings transparency to...

CTP tender process delayed again

The FCA has again delayed its publication of consolidated tape provider (CTP) tender documents.

At the end of 2024, the authority stated that the documents...

Viewpoint: MarketAxess to increase automation with Adaptive Auto-X

MarketAxess is aiming to initially launch Adaptive Auto-X in the first half of this year to provide clients with algorithmic workflows and allow them...