Refinitiv puts Tick History data on Google Cloud

Refinitiv has launched its Tick History dataset on Google Cloud Platform (GCP), letting customers access, query and analyse Refinitiv’s extensive archive of pricing and...

The Agency Broker Hub: When multi-execution means best execution

Umberto Menconi, head of Digital Markets Structures, Market Hub, Intesa Sanpaolo IMI CIB Division

In fixed income markets how do different execution models (principal, matching, agency)...

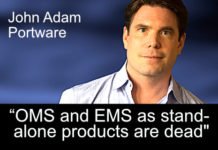

Portware claims ice cracking on EMS/OMS division

By Flora McFarlane.

“The order management system (OMS) and to an extent the execution management system (EMS) as stand-alone products are dead,” says John Adam, global...

Mixed trading volumes in May for fixed income across platforms

Looking at the numbers from the major trading platforms in May, volumes appear to be recovering which will be positive for dealers, who saw...

Tradeweb files for IPO

Market operator Tradeweb Markets, has filed a registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a proposed initial public...

CME Group to launch Chicago UST CLOB

CME Group is launching a second BrokerTec central limit order book (CLOB) for cash US Treasuries in Q3. Client testing begins on 27 April.

The...

Citigroup Global Markets hit with $2.9m SEC underwriting expenses recordkeeping penalty

Citigroup Global Markets (CGMI) has settled a US$2.9 million penalty with the US Securities and Exchange Commission (SEC) for underwriting expenses recordkeeping violations.

The SEC...

US president to oversee financial institution regulation amid deregulation drive

New executive orders signed by US president, Donald Trump, have given him oversight of all US financial regulation, outside of monetary policy, while also...

SEC’s issuer proposal on cyber security risk ‘a step further than Sarbanes Oxley’

US market regulator, the Securities and Exchange Commission (SEC), has proposed amendments to its rules to enhance and standardise disclosures regarding cybersecurity risk management,...

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Subscriber

On The DESK : Gianluca Minieri, Pioneer Investments

The Greatest Concentration of Risk

Gianluca Minieri has been the global head of trading at Pioneer Investments since 2011, driving reform across trading operations, including...

Primary markets start 2023 with top ten hit

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is...