The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Industry viewpoint : Regulation & data : MTS

Securities Financing Transactions Regulation (SFTR)

Q&A with Tom Harry, Regulatory Specialist, MTS

How well prepared are institutions for the impending requirements of SFTR?

Most repo market participants...

Chinese equity sell-off leaves locals “more cautious” on debt

Buy-side traders in the Chinese debt markets are noting some effect from the equity sell-off, which was triggered by concern around government and regulatory...

Splinters of a market

While liquidity in US investment grade (IG) markets has been holding up relatively well, MarketAxess data shows us that the past month has seen...

Redburn sees value in bond market venue M&A

Analysis by broker Redburn has found that major exchanges – in which it included MarketAxess, the fixed income trading venue, and interdealer broker TP...

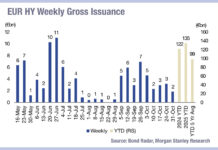

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Portfolio Trading and price discovery in US IG and HY markets

By Jessica Hung and Chisom Amalunweze

In our PT vs RFQ List White Paper, we found that PT provides superior execution outcomes for illiquid bonds,...

Analyzing chair Gensler’s comments on TRACE reporting

By Julien Alexandre & Grant Lowensohn

Highlights

The SEC chair recently announced the SEC was considering reducing the reporting window for US corporate bond transactions to...

Tradeweb and FTSE Russell launch closing prices for Euro govies

Multi-asset market operator, Tradeweb Markets, has collaborated with FTSE Russell to launch benchmark closing prices for European government bonds.

Calculated in accordance with the...

Rates traders drop e-trading in April volatility

E-trading in US rates markets fell during April, with traders flocking to voice amid Treasury turmoil.

ADNV in US Treasuries spiked to US$1.342 trillion, up...

Messaging tools spike as remote trading takes off

Providers of messaging tools used by portfolio managers, buy-side traders, sales traders and sell-side dealers have seen volumes spike as remote working becomes a...

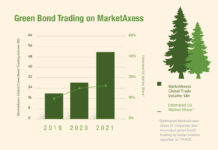

Trading for Trees

In 2019 MarketAxess launched their “Trading for Trees” program, under which five trees are planted by One Tree Planted, a partner charitable organization, for...