Can greater automation throw the industry a much-needed lifeline?

Vincent Kilcoyne, EVP, Product Management, at SmartStream Technologies assesses the impact of the coronavirus pandemic on the future of banking.

The coronavirus pandemic has had...

Amundi US and Victory Capital to merge in new 15-year partnership

European asset manager Amundi is set to become a strategic shareholder in global asset management firm Victory Capital, following a signed Memorandum of Understanding...

Finsmart set to launch DealPro for bond issuance this year

Finsmart plans to launch DealPro, a secure application to connecting underwriters and issuers in debt capital markets, later this year. The application is intended...

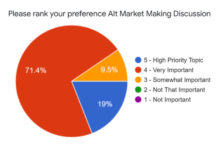

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Subscriber

Fixed income platforms buoyed as all-to-all expands

Fixed income electronic trading platform operators have announced record trading volumes in the first quarter of 2017.

MarketAxess, platform operator for dealer-to-client and all-to-all trading...

White-paper summary: Filling the liquidity gap in bond index construction

Industry viewpoint: State Street Global Advisors SPDR® and MarketAxess

The success of ETFs in supporting bond market liquidity has been marred by a gap in...

Bajaj Finserv Asset Management adopts Bloomberg AIM

Bajaj Finserv Asset Management Limited (BFAML), has adopted AIM, the Bloomberg order and investment management system (O/IMS).

BFAML reportedly selected Bloomberg AIM in an effort...

How to overcome the hidden challenges of new derivatives regulation : OpenGamma

By Peter Rippon, CEO, OpenGamma.

New regulation introduced to mitigate the systemic risk associated with both cleared and uncleared OTC derivatives has also brought about additional...

Cartel cases in SSA market continue as Rabobank fined €26.6m

The European Commission has fined Rabobank €26.6 million for participating in a cartel trading Euro-denominated bonds

The Commission alleges that between 2006 and 2016 Rabobank...

IDX: Bumper election year could be less disruptive than feared

Political instability feels more of a threat than ever, but what impact is it really having on markets? Exchanges weighed in at this year’s...

Market structure: Is e-trading plateauing?

The overall pace of bond market electronification is slowing, but trading evolution is not linear.

Electronic trading has grown as a proportion of total trading,...

Overbond and Rapid Addition form strategic alliance for bond trading automation

Overbond’s fixed income artificial intelligence (AI) will now offer protocol and system agnostic integration with venues and electronic trading systems used by sell-side and...