Swaps market implies no rate change from FOMC

Data from the swaps market implies participants expect to see policy rates unchanged after the Federal Open Markets Committee (FOMC) meeting this week.

Looking further...

Insights and Analysis: Citadel Securities challenges primary market conflicts

A year ago, rumours in the bond markets suggested that Citadel Securities might be planning a move into bond issuance, a move which buy-side...

Low volatility hits Q2 MarketAxess earnings

Bond market operator, MarketAxess, reported revenues of US$176.3 million in the second quarter of 2021, down 4.6% against Q2 2020.

“Second quarter results were heavily...

Citi Markets bets on Asia growth

Citi Markets expects to increase headcounts in its Asia rates and prime businesses over the next year as market activity booms, it says.

The company...

Acuiti and Eventus report: Complexity of trade surveillance shows ‘significant’ increase

Analyst firm Acuiti’s latest report, ‘Getting to the risk quicker: How trade surveillance leaders are dealing with an increasingly complex environment’ has found that...

What EM trade sizes tell us about market evolution

While issuance of emerging markets bonds beat the same period in 2023 by a third, secondary trading is far more choppy, with a stepped...

Liquidnet’s research reveals liquidity conditions improving

A survey of US and European bond traders has revealed that the liquidity in the fixed income markets is improving.

The research, published by the...

Subscriber

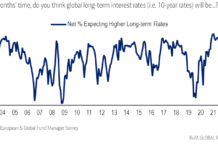

BofA: ‘Universal gloom’ in fund manager survey

The latest fund manager survey by BofA has found that a net 92% of survey participants expect a recession in Europe over the next...

Industry viewpoint : Mike du Plessis : UBS

COMING TO TERMS WITH THE NEXT PHASE OF MARKET TRANSFORMATION.

By Mike du Plessis, Managing Director, UBS Global Head of FX, Rates & Credit Execution...

The breakdown: How asset managers are tackling fixed income unbundling

By Flora McFarlane & Dan Barnes.

With the revised Markets in Financial Instruments Directive (MiFID II) set to arrive in just under five months, buy-side...

Subscriber

TP ICAP connects dealers to Liquidnet’s New Issue Trading protocol

TP ICAP, the interdealer broker, market infrastructure and information provider, is enabling dealers to join the buy-side in placing orders and trade directly on...

ION LatentZero connected to UBS Bond Port for buy-side

Trading, analytics, and risk management system provider, ION Markets, has connected its LatentZero buy-side clients to the UBS Bond Port trading platform. Bond Port...