CME Group folds FX futures, options, cash and OTC FX business into single unit

CME Group has folded its FX futures, options, cash and over-the-counter (OTC) FX businesses into a single unit led by Paul Houston which the...

SEC proposes new central clearing rules for US Treasury market

US market regulator, the Securities and Exchange Commission (SEC) has proposed rule changes to enhance risk management practices for central counterparties in the US...

Symphony’s new president outlines his vision

Brad Levy, the new president and chief commercial officer (CCO) of Symphony, the capital markets communication network, has outlined his vision of the company’s...

Federated Hermes trades “less than 5%” on e-trading platforms

The chief investment officer (CIO) of asset manager Federated Hermes investments (FHI), which has US$758 billion in assets under management, has said the firm...

Five dealers select Droit for MiFID II Compliance

By Flora McFarlane.

BNP Paribas, Crédit Agricole CIB, Goldman Sachs, Lloyds and UBS are using Droit Financial Technologies for MiFID II trade compliance infrastructure.

Jo Hannaford,...

China Bond Connect launches real-time DvP and block trading

By Pia Hecher.

Mutual market access scheme Bond Connect, the platform linking investors from Mainland China and overseas, implemented real-time delivery-versus-payment (RDvP) and introduced a...

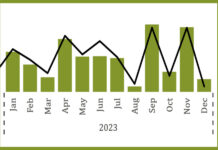

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

Credit Agricole, R. Seelaus & Co. and Siebert Williams Shank join DirectBooks

Credit Agricole Corporate & Investment Bank, R. Seelaus & Co. and Siebert Williams Shank have joined the primary bond market platform operator DirectBooks. The...

Discussions between TP ICAP and Neptune reported

Multiple market sources have reported that discussions between pre-trade data provider Neptune and TP ICAP, the multi-asset trading, interdealer broker and data services firm,...

BNY Mellon & GLMX connect buy-side repo trading to triparty

BNY Mellon and fintech firm, GLMX, are allowing buy-side clients to direct repo trades at point of execution to BNY Mellon's Triparty platform.

This...

TABB Group shuts down

Larry Tabb, the eponymous founder of market anayst firm TABB Group, has announced the firm will close. Making the announcement via Twitter, he wrote:...

The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...