Ham leads Barclays IB

Alex Ham has been named global chairman of investment banking at Barclays, effective early 2026.

In the London-based role, Ham is responsible for furthering Barclays’...

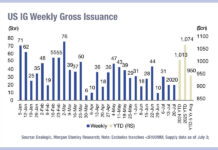

Year-to-date issuance higher in corporate bonds as leveraged loans drop

Issuance of corporate debt in the US and European markets is looking relatively strong year to date, however loans have tailed off significantly, according...

CME, DTCC boost cross-margining services

DTCC and CME Group have expanded their cross-margining initiative for clients of CME and the Government Securities Division (GSD) of DTCC's Fixed Income Clearing...

RLAM appoints Kevin Flood as head of dealing

Royal London Asset Management (RLAM) announces the appointment of Kevin Flood as head of dealing. Flood has been with RLAM for nearly three years...

MeTheMoneyShow : Cryptic problems for US regulators

In this podcast Dan Barnes speaks with Terry Flanagan and asks whether Europe is leading the race for exchange traded products? They discuss the...

SEC: Leech charged with cherry picking trades for WAMCO funds

The SEC has charged Ken Leech with fraud. The bond trader was former co-chief investment officer at Western Asset Management (WAMCO), which holds US$336.1...

JP Morgan leads DCM amidst primary markets retreat in Q1 2025

In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the...

What will shape Europe’s bond market in 2025

The European bond market is under pressure from several dynamics which are shaping its evolution, with implications for investors and issuers.

Andy Hill, senior director...

Julia Perroni joins Houlihan Lokey’s capital markets business

Global investment bank Houlihan Lokey has named Julia Perroni as a managing director in its capital markets business.

Based out of Paris, Perroni will head...

Keeping the doors open

Erika Bianco, Senior Marketing & Communications Manager, EMEA & APAC at MarketAxess and Camille McKelvey, Head of Post Trade STP Business Development at MarketAxess talk...

FCA consulting on bond and derivative markets transparency reforms

The UK’s Financial Conduct Authority (FCA) is consulting on proposals to improve the transparency regime for bond and derivative markets.

The consultation, which is open...

Greenwich Associates: European fixed income trading becoming more concentrated

Regulatory changes and difficult market conditions have made European fixed income a more challenging business for banks, according to analyst house Greenwich Associates, leading...

Subscriber