Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Press Release: Laurie McAughtry joins Markets Media as Managing Editor of Best Execution

Markets Media is pleased to announce the appointment of Laurie McAughtry as managing editor of Best Execution Magazine, with former editor, Lynn Strongin Dodds,...

Trading protocols: The pros and cons of getting a two-way price in fixed income

Getting a two-way price is unusual in fixed income trading, but normal in FX; that is changing and yielding some real results for best...

Molloy joins Morgan Stanley Investment Management

Mark Molloy has joined Morgan Stanley Investment Management as a macro trader. He is based in London.

Morgan Stanley Investment Management holds US$1.6 trillion in...

Buy side issues framework to standardise bond issuance

The Credit Roundtable, a buy-side lobby group for bondholder protection has issued an ‘Investment Grade Primary Best Practices Framework’ designed to improve bond issuance.

The...

Bloomberg machine learning pricing solution enhances fixed income trading visibility

Bloomberg’s Intraday BVAL (IBVAL) Front Office is now available to Bloomberg Terminal customers, as well as users of Bloomberg’s real-time streaming market data feed,...

Industry viewpoint : SIX Swiss Exchange : Frédéric Messein

Better interdealer execution generates natural liquidity

Banks’ reticence to trade with clients is a consequence of the cost of carrying risk; SIX Corporate Bonds de-risks...

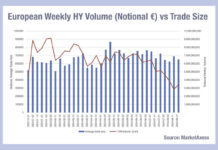

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

CME Group completes migration of BrokerTec trading platform to CME Globex

Market operator CME Group has migrated the US Treasuries trading and US repo functions of BrokerTec business to its CME Globex platform. This follows...

Viewpoint: Establishing a clear path forward

Tim Whipman from TransFICC provides an update on the consolidated tape for European fixed income, and explains the key requirements, hot topics and technology...

Bloomberg broadens EM bond pricing coverage

Bloomberg has expanded its intraday valuation (IBVAL) front office service to cover emerging market (EM) bonds on a 22/5 basis.

Launched in 2023, IBVAL provides...