EM debt funds on a winning streak for inflows

According to Morgan Stanley analysis, emerging market (EM) debt funds have seen eight weeks of inflows over the summer period, representing the longest streak...

Reimagining RFQ for Credit: The building blocks to a truly flexible approach

By Chioma Okoye, Managing Director, European Institutional Credit, Tradeweb

Innovation, automation and collaboration – the key to returning operational capacity back to the trader in order...

Origination: SocGen’s Sogecap issues €800 mil in perpetual notes

Societe Generale’s life insurance company Sogecap has issued €800 million in restricted Tier 1 perpetual notes.

Perpetual notes have no maturity date, and are non-redeemable....

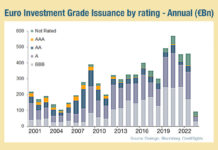

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...

SEC fines ten broker-dealers US$289m for recordkeeping violations

Ten sell-side firms have been fined a combined US$289 million by the US Securities and Exchange Commission (SEC) for violating recordkeeping provisions.

The...

TransFICC: The European bond market – changing by the microsecond

By Judd Gaddie, Co-Founder TransFICC

Advantages have always been sought by traders, often resulting in a race to obtain information before competitors. Incorporating new technology...

Fenics Market Data appoints Jonathan Syrén as head of new product development

Fenics Market Data has named Jonathan Syrén as head of new product development, based in London.

Syrén moves from Parameta Solutions, which he joined in...

MTS and Wematch.live launch risk netting service for interest rate swaps on Euronext

European electronic fixed income platform MTS and fintech Wematch.live have successfully trialled the first session of the risk netting Service for interest rate swaps...

Will the EC ban electronic bilateral bond trading?

The broadening definition of ‘multilateral’ is at risk of capturing all trading if traders do not speak out.

The European Securities and Markets Authority (ESMA)...

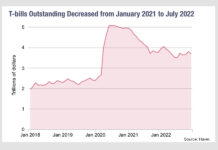

Treasury bill supply and ON RRP investment

By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased...

Derivatives – Viable alternatives

Tougher capital and liquidity constraints for OTC assets are boosting exchange-traded products appeal to the buy side. Anna Reitman reports.

As trading over-the-counter (OTC) for fixed...

Glimpse Markets and TORA connect to support buy-side traders

Glimpse Markets, the buy-side data sharing hub, has partnered with order and execution management system (OEMS) provider TORA.

By connecting TORA’s OEMS with Glimpse...