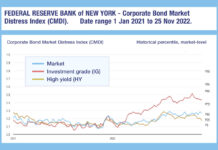

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

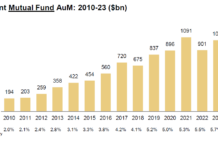

How big can systematic trading get in credit?

Investors can achieve significant advantages though systematic trading, such as reduction of trader/investor bias, and responsiveness to signals. However, there are limits to the...

Allianz GI: On strength of voice

Effectively communicating across trading desks, teams, counterparties and industry is allowing Allianz Global Investors to stand out amongst asset managers. The DESK talks to...

Industry viewpoint : Trading U.S. Treasuries : Josh Holden

Beige:

US Treasuries path forward likely to be moulded by lessons of other markets

By Josh Holden,

Chief Information Officer, OpenDoor Trading

At OpenDoor we recently celebrated the...

OpenYield Trading prints first trade

Broker-dealer and alternative trading system OpenYield Trading has launched, printing its first trade.

OpenYield is designed to make access to the bond market easier and...

FILS 2022: Could ESMA ban RFQs?

The future of the request for quote (RFQ) protocol was being challenged both on and off stage at the Fixed Income Leaders’ Summit in...

Market volatility and automated trading decision-making

Gain greater confidence in your automated trading decisions during market volatility

By Charlie Campbell-Johnston, Managing Director, AiEX & Workflow Solutions at Tradeweb.

In times of volatility, traders...

TS Imagine’s Spencer Lee joins MarketAxess

MarketAxess has appointed Spencer Lee as head of client product for the Americas, effective 12 May.

In the San Francisco-based role, Lee will cover business...

Tradeweb saw ADV hit US$1 trillion in January 2021

Market operator Tradeweb has reported its total trading volume for January was US$20 trillion across its electronic marketplaces for rates, credit, equities and money...

Buy-side desks find favour in credit futures

The expansion of Eurex’s credit futures offering into dollar and multicurrency products promises broader and deeper opportunities for investors.

A keen buy-side appetite for credit...

European Women in Finance : Tamara Murray : Keeping the pace of change

Tamara Murray, Head of HR, EMEA and APAC at MarketAxess talks to Lynn Strongin Dodds about Covid, Brexit and empowering talent.

Finding and keeping talent...

Glimpse Markets goes live

Glimpse Markets, the buy-side data sharing service, is officially live with a group of global asset managers sharing post-trade bond data with one another...