Effectively communicating across trading desks, teams, counterparties and industry is allowing Allianz Global Investors to stand out amongst asset managers. The DESK talks to Jutta Schneider, European head of fixed income trading, Eric Böss global head of trading and Rachel Muscatt, head of dealing at Allianz Global Investors.

What must a trading desk do to provide value for the wider firm?

Rachel Muscatt (RM): All the desks I have ever created have always had sell-side traders. It’s important that traders know when to be a taker of risk, to add some relative value as a dealing team, to add incremental basis points to your portfolio manager (PM). Our dealing desk in London is integrated within the investment team. For the global fixed income business it’s important for us to understand which element a PM is looking at, be it sector, currency, or maturity for example. That allows us to propose a range of alternative ideas.

How would you characterise the different qualities of electronic and voice trading?

Jutta Schneider (JS): Over 90% of our business is electronic and that number has been pretty stable over the last few years. eTrading mainly depends on the asset classes and sizes you trade as a buy-side firm. Some trading platforms made huge progress over recent years, giving several different smart options to trade and execute electronically, either in specific asset classes, sizes and counterparts you can trade with. The sell side got used to increasingly electronic trading with buy-side clients.

Sizes you can easily execute electronically have risen and open inquiries to a platform have opened up the potential counterparts for matching business. You are facing the platform instead of the broker, giving you the possibility of a broader range of brokers, leading to better execution prices. Nevertheless, electronic does not mean that a trader does not have to know her counterparty. Even when executing electronically a buy-side trader has to know their markets, where liquidity or axes can be found. Electronic trading does not substitute a trader, it is a smart tool in her hands but does not replace traders and their market knowledge.

RM: There is a case for using platforms, on the other hand, voice trading is always going to be there, it needs to be there. While the industry is championing transparency, intrinsically it’s not always desirable when you are trying to do an asset allocation, or a shift out of one sector into another, the best trade that you really want is traded under the radar with very little slippage.

Jutta, why is your level of electronic trading so high (proportionate to most FI desks) and how is that difference reflected in the makeup of your team?

JS: The high level of electronic trading is due to the nature and needs of our business. We are handling a high number of small to medium size tickets every day. Most of them are fairly liquid. Hence electronic trading absolutely fits our needs. It allows us to cope with a high trading volume.

From the very beginning our team closely followed developments on electronic trading and tried out different platforms. Some of them convinced us and some did not provide enough added value and we skipped them.

Does that materially impact best execution?

JS: A high level of electronic execution does not in itself lead to best execution. Traders need to be aware which platform is best for different types of inquiries. They need to be sensitive with large volume trades or illiquid bonds. They need to look out for axes and know which broker is strong in what asset class. Also, communication with sales and traders is still key to finding the best price in the market, so in a way the scalability eTrading delivers is needed to free up time for the more difficult trades.

My team is made up of senior traders all with different backgrounds and experience. They are curious by nature and willing to try out new ideas and tools. New requirements such as MiFID II challenge us all, but with a strong and curious team we manage to meet the needs: to handle the high work-load, respect the legal boundaries and still find the best prices for our PMs.

Trading is more visible under MiFID II best execution reports and PRIIPS disclosure of transaction costs for funds; has that changed the way that trading teams are viewed?

Eric Böss (EB): The publicly disclosed versions of transaction costs have little resemblance to reality as you have seen from the first reports recently. You might argue that’s a result of the methodology allowed by the rules, which actually make limited sense and rather confuse the end investor. However, there are a lot of sensible applications for transaction cost analysis (TCA), which is a newer kid on the block in fixed income versus the equity world.

RM: The TCA model in a fixed income world is better than nothing and clients want to see some level of TCA. However, when you are trading credit and you are hedging that is not capturing the spread that you traded at. It’s effectively looking at a price and where that price was at that time. When you are trading a corporate bond, if you see spreads are moving, and the underlying government bond is moving, those can be all over the place.

Is there a way to make TCA more valuable?

RM: TCA should be embedded within the investment process decision making. When you are looking to do a switch or to shift out of a sector, you should be aware of how much that is going to cost. If you are only going to make 20 basis points (bps) on it, and you are trading two different corporate bonds that trade on the very long end that trade on a five or 10 basis points bid/offer, that switch has really got to work for you to make any money on it.

Has engagement with end investors changed as a result of MiFID II?

EB: If anything, trading is a little bit more on the forefront because clients are more curious about how we approach it.

JS: What we have seen over the last couple of years are clients who want to come and see the trading desk to get a deeper insight into bond trading. They are curious to see how trading is done, from the creation of a trade or trade idea up to the execution of the trade, the communication between PM and trading during the set up and trade. So it is not an everyday contact with the end investor from our side, but not infrequent either.

EB: We even see it with prospective clients visiting the trading floor for whole days in exchange programmes.

Do you think that asset managers could be shaping market structure more purposefully than they are at the moment?

EB: We are all competing for the same end clients, but part of the larger shift between what the sell side offers and what the buy side has to manage on the trading desk means there is more engagement from the buy side to shape the marketplace. If you look at buy-side initiatives like Neptune there definitely is more engagement than a couple of years ago. We speak to each other but they are still our competitors, so I think there are more conversations among the buy side taking place around market structure.

JS: I think it’s important to have that engagement between buy-side firms since we all face similar problems with the same topics, it does make sense to have a more active exchange.

Has your use of electronic trading changed compared to 12 months ago?

JS: At our desk, 90-92% of our business has been electronic for several years already. Could that change in one way or another in the future? Maybe. It always depends on the market situation, volatility, market expectations, liquidity and sizes to be traded.

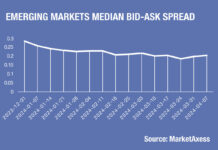

RM: In London there has been no change, but around 40 per cent is traded electronically in volume size, and the remaining 60 per cent is via voice. We are in the global fixed income business so a large proportion of that is in dollars. If you look on MarketAxess, which is probably the leading dollar platform, about 77 per cent of trading is for US$5 million or under. The US market funnily enough is still very much more voice-based than the European market.

Has MiFID II had any effect?

JS: We have seen changes in the size of electronic trades for certain liquid assets in the last 12 months. Under normal market circumstances and volatility levels you can now easily, for example, switch up to Ä300 million in a Bund to a France 10-year, so that has increased over the last year. But that only applies to liquid asset classes and normal market conditions.

For other asset classes which are less liquid, even there the amounts you can easily execute electronically moved up but not in the same way as liquid products did. Was or is MiFID II the main driver? It is one of them, but not the main driver; markets already got more and more electronic over the past years.

RM: In London 50 per cent plus is still voice, which allows the traders to look at more complex strategies and more illiquid assets that need that softer touch in the street. You have be discrete and respectful when you are dealing in large size because the street isn’t as big as it used to be, and you only need one heavy handed trade out there to affect a particular bond, or even sector.

EB: The need to trade on platforms in Europe under MiFID II has unleashed the creativity of market participants, especially at platforms like Tradeweb or MarketAxess. They will most likely come up with trading protocols that are technically electronic, but will try to mimic the old school soft approach trading for larger scale orders. It will be interesting to watch how we move that historic relationship-based voice trading into more electronic formats without changing the nature of the trade.

Is your counterparty list changing?

JS: We have a large list, and that hasn’t changed so far. At the moment I am feeling quite comfortable with it. How that might be affected in the near term we will have to see. Certain banks left and are leaving asset classes behind, so maybe that will change in the next six to 12 months.

RM: Five years ago I would have had my top 10 counterparts getting 85 per cent of my business. We still have houses with an appetite for risk who we know will print trades. But there are specialist boutiques within the bigger firms and the tail of smaller firms has grown.

EB: That is effectively the opposite direction you are seeing in equities where the middle part of the broker list is under heavy pressure.

How has your use of non-cash tools been evolving over the last couple of years?

EB: ETFs, futures and CDS are beta instruments, and our prime user group is in risk management and asset allocation, so they increasingly use those types of instruments. Ten years ago, all you had were three points on the treasury and Bund curve you could use as duration management tools. Now you’ve got beta instruments for different types of credit, even for sectors and sometimes sub-sectors. That has been taken up, but it hasn’t really grown fully into a tool for classic, active fixed income portfolio management. The main users are still more passive allocators and sector investments. I expect that to be one of the big growth stories to come.

ETFs are the new futures, and they actually serve a purpose. If you have got a small inflow of Ä5 million into a bond portfolio which holds 200 names, you don’t want to buy 200 names or a selection of 20, you just want something that roughly represents your beta and then gradually work the more difficult idiosyncratic names in credit with more time.

Where people are moving more traditionally OTC rates and credit products onto listed instruments, will that trend continue?

EB: The exchanges have not been very successful in creating good new fixed income or credit products on listed markets. You see an increase in central clearing of existing OTC products, which were traded bilaterally historically. But show me one of the big exchanges that came up with a sensible, new fixed income product that gained traction with the market recently.

If you were able to come up with a concept in the market or to advance one of the concepts already there, what would you do?

RM: Jutta and I would like a market as a version of Amazon. The platforms are all very useful, but you do need to trawl each system to ensure that you capture everything.

JS: I think there are some smart initiatives, but the link between them is missing. A provider who reflects everything on one screen, so you do not have to shop around in different systems, aggregating data.

Do you think that the link is inevitably going to have to be an internally-built system?

EB: Even Algomi’s ALFA product was an internal system they now market to third parties, and we are looking at building one internally because we like what we see in the likes of ALFA, but we find the pricing a little bit difficult. The fact that APIs are easier to manage than they were five years ago, might just move the needle in terms of our decision there. We are monitoring this area because it’s clear what our traders want, which is aggregated access to very fragmented sources of information.

Do you think that demand for trading desks to add value to the portfolio is going to increase?

RM: Definitely. If an order comes up you need to be able to go back to the PM and give them a menu of options. From experience, portfolio managers want to see if there is better value to realise what they are trying to achieve within their portfolios. There are firms that allow their fixed income desk to trade their own P&L and act as a prop desk. They will say it keeps their traders sharp because they have a vested interest. But how do you monitor every trade that a buy side desk is actually executing on their own books, and what they are actually executing for their clients?

EB: There are much smarter ways to achieve that. Our equity traders are partially paid depending on their TCA results, something that I currently don’t expect in the near future in fixed income. But you can have solidarity goals. You can link traders’ pay to specific strategies’ performance to a certain extent. There are good ways to achieve traders becoming an integral part of the investment process, and having skin in the game.

Crossing internally can offer advantages, but can end investors understand how it fits with best execution if you are not going out to the market?

EB: We have had end clients asking us effectively the opposite question, which is ‘Why don’t you cross internally?’ Our European business has always looked at internal crossing as a way to save costs. If you have got the right protocols around it to avoid any conflict of interest or other potential issues it’s a good way to trade, but in reality it is not a big part of our business.

Eric, we have seen increasing M&A activity in the business, what must a head of trading do to get the best from two trading teams following a consolidation?

EB: Respect and leverage different cultures while giving them a scalable infrastructure to work on.

Running a large and diverse trading team that serves a multitude of different strategies with different needs in different locations will always require a certain level of compromise, mainly on the technology and process side. But, if we manage to keep the required standardisation to a minimum and leave good traders with the leeway they need to perform and support PMs to achieve their investment targets, we have a promising starting point.

©TheDESK 2018

TOP OF PAGE