Rules and Ratings: EU associations call for credit rating-led bond transparency

AFME, the German Investment Funds Association (BVI), Bundesverband der Wertpapierfirmen (bwf), EFAMA and ICMA have encouraged the EU to calibrate corporate bond transparency regimes...

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...

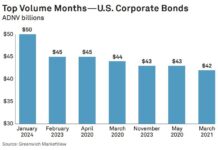

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

Morgan Stanley analysts predicting Q4 was tough for bank FICC revenues

Morgan Stanley analysts, looking at the performance of investment banks in Q4 2021, are predicting a significant fall in revenues across fixed income, commodity...

If you go down to the woods today…

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%,...

Balls calls for UK to adopt a more risk-assertive culture

Ed Balls, former economic secretary to the UK Treasury & shadow chancellor, has called for the UK to adopt a risk-positive culture in order...

Private credit: “Don’t get involved now!”

Louis Gargour, chief investment officer at LNG Capital gave this late-cycle warning at a FILS panel dedicated to alternative investment in private credit. He...

Octaura and Allvue push ahead on loan market electronification

Octaura and Allvue have partnered to boost electronic trading in loan markets, combining their solutions for alternative asset manager ICG.

Octaura, which provides electronic trading,...

The fall of Europe’s brokers

Reduced competition could lead to higher prices for buy-side bond traders.

The collapse of European brokerage houses is hitting buy-side trading desks in two ways....

Research: OMS/EMS Survey 2022

Traders prioritise O/EMS analytics as liquidity dries up

OMS/EMS stacks need to help traders assess trading conditions in 2022.

The DESK’s research into buy-side execution and...

Subscriber

On The Desk: Christoph Hock: On building efficiency

Union Investment’s development of a multi-asset trading team and segregation of high and low touch business is allowing it to focus trading resource where...