LDA slashes market data distribution times

Ultra-low latency and circuit and network solutions provider LDA Technologies has launched a tool to synchronise market data distribution in an effort to democratise...

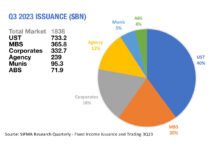

This! Is! What! Liquidity! Looks! Like!

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

FILS 2024: “We really want to see streaming”

Increasing levels of indexation, exchange traded fund (ETF) use, and data availability paint of picture of deeper, more automated credit markets in the future,...

FILS 2024: Implications of syndicated loan expansion

The importance of including syndicated loans in portfolios was highlighted at this year’s Fixed Income Leaders Summit (FILS) Europe.

The syndicated loan market is growing...

The Book: Clearstream’s D7 hits €10 billion in digital issuances

Clearstream’s digital securities platform, D7, has reached €10 billion in issuance volumes. The firm reports that the service completes up to 15,000 new digital...

Clearwater bets on portfolio visualisation services with dual purchase

Clearwater Analytics is acquiring two portfolio visualisation tools to offer a whole-portfolio view for clients across public and private markets.

Beacon provides cross-asset class modelling...

UBS CIO: Ways to find income in a low rate world

Mark Haefele, chief investment officer for Global Wealth Management at UBS has provided guidance, alongside a team of strategists, on where investment opportunities exist...

FILS USA: Entry point for private credit liquidity providers “never been better”

Private credit has expanded rapidly in recent years, with the IMF recently reporting that the size of the market topped $2 trillion globally, of...

Camille McKelvey: Time to turn things on their heads

Shanny Basar spoke to Camille McKelvey, Head of Post Trade STP Business Development at MarketAxess, about languages, diversity in the workplace and career paths.

She...

The election effect: Secondary markets

While the effect of an election on the markets is typically subdued on the day itself – more so when the outcome is uncertain...

The DESK on Radio 4’s Thinking Allowed

The Desk's managing editor, Dan Barnes, was a guest on BBC Radio 4's Thinking Allowed, discussing the role of retail traders in the market,...

Perpetual selects State Street’s Charles River to manage front office ops

State Street subsidiary Charles River Development has been tapped by Perpetual Group to manage its front office operations for the firm’s Australian asset management...