TS Imagine releases new features for TradeSmart Fixed Income EMS

TS Imagine, the investment and execution management system (EMS) provider has launched several new features of its TradeSmart Fixed Income EMS, all designed to...

Euronext launches government bond index family

Euronext, in partnership with its electronic fixed income trading platform MTS, has launched a European government bond (EGB) index family.

Derived from the “mother index”,...

Daniel Swaby rejoins Liquidnet

Daniel Swaby has returned to Liquidnet as a sell-side trader.

Swaby has almost 15 years of industry experience, most recently serving as a director at...

Bond trading disrupted as ICSDs close to ruble settlement

International central securities depository (ICSD) Euroclear has announced it will no longer settle ruble-denominated transactions from 1 March 2022 until further notice.

The firms reported...

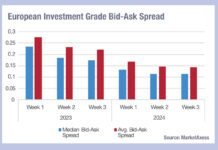

What is behind the falling cost of IG liquidity?

The bid-ask spreads in credit trading across the Europe and US have fallen dramatically in the first three weeks of 2024, relative to the...

Beyond Liquidity: Optimism grows for European consolidated tape

Investors have been calling for a consolidated tape in Europe, which gives them aggregated data on trading volumes and prices throughout the region in...

Man AHL co-CEO outlines value of AI in asset management

By Dan Barnes.

The extent to which AI can be used in the investment and trading space is fiercely debated.

Matthew Sargaison, co-chief executive officer, Man AHL...

MSCI and MarketAxess collaborate on liquid fixed income indexes, portfolio construction and ESG

MSCI and MarketAxess are entering into a strategic collaboration to create portfolio analytics solutions and co-branded fixed income indexes incorporating MarketAxess liquidity data.

MSCI plans...

7 Chord to integrate Glimpse Markets’ bond transaction data

7 Chord, an independent provider of predictive prices and analytics to fixed income traders, issuers, and investors, has become the first AI pricing vendor...

Traders respond positively to MarketAxess/LiquidityEdge deal

Buy-side traders have responded positively to the announcement that electronic bond market operator, MarketAxess, has agreed to buy LiquidityEdge, the US Treasuries marketplace, noting...

Bryan Harkins joins Trumid

Electronic credit trading platform Trumid has appointed Bryan Harkins in the newly created role of chief revenue officer.

Harkins is an experienced executive with expertise...

Instinet veteran flips to Liquidnet

Liquidnet has appointed Mark Turner as managing director and co-head of sales and trading for the Americas.

Turner has been a managing director at Instinet...