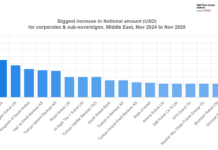

Electronic bond trading expanding to match MENA markets rapid growth

Bond markets in the Middle East & North Africa (MENA) region have seen primary and secondary activity surging in 2025, reflecting individual country’s sovereign...

US Fixed Income Leaders Summit delayed

The Fixed Income Leaders Summit in Nashville which had been planned to take place in June 2020, has been postponed in light of the...

CME saw record volumes for US Treasury complex on 28 May

CME Group saw record volumes for its US Treasury complex on 28 May, with 34,350,339 contracts traded.

The figure surpassed its previous record of 33,322,608...

Jim Kwiatkowski named CEO of LTX, Toffey becomes chairman of the board

LTX, Broadridge Financial Solutions' bond, digital trading business, has promoted Jim Kwiatkowski to the role of CEO.

Jim Toffey, co-founder of LTX, will succeed Art...

Electronic trading volume in US fixed income hits record

Electronic trading of US investment-grade and high-yield bonds reached an all-time high in July according to data from Coalition Greenwich.

Overall electronic trading accounted for...

Research: Competition proves tough for O/EMS providers

Onboarding time shows the challenge facing EMS & OMS firms but algo trading increases demand

Two years ago Flextrade had a big pipeline of new...

Subscriber

Jane Street issues US$1.35 billion bond as market makers bulks up balance sheet

Jane Street, the high frequency trading (HFT) firm, issued 6.75 % senior secured notes highlighting how proprietary dealers are now locking in long-term funding...

ICE Data Services publishes key fixed income indices in real time

Market operator, infrastructure and benchmark provider Intercontinental Exchange (ICE) has announced that ICE Data Services has launched real-time publication of several of its most...

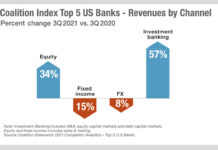

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

ICMA: Adopt data-driven approach to MIFIR RTS 2 post-trade deferral framework

The International Capital Market Association (ICMA) has co-signed a cross-industry statement on the MIFIR RTS 2 post-trade deferral framework for bonds, calling for a...

Derivatives : Exchange-traded products : Joel Clark

Why listed derivatives struggle to address risk

Some traders have been critical of listed products designed to replicate OTC derivatives, but exchanges are working hard...

Yarkova-Valente joins Trading Technologies

Oxana Yarkova-Valente has joined Trading Technologies as a sales executive.

Yarkova-Valente has close to 25 years of industry experience and joins the firm from MTS...