SEC committee proposes TRACE block trading delay

The Securities and Exchange Commission (SEC) Fixed Income Market Structure Advisory committee met on 9 April 2018 to discuss a proposed pilot for a...

High demand for effective trading protocols

Buy-side traders, whether heavily reliant on voice trading or moving to a more electronic execution model, say they are keen to find effective protocols that...

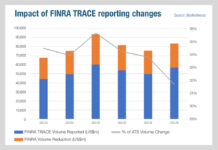

TRACE recalibration exposes double counting

An adjustment to bond trade reporting to TRACE, the US post-trade reporting tape for fixed income, has cut the volume of trades arranged via...

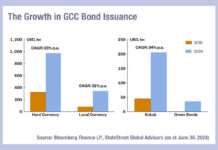

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

US agencies report on US Treasury market changes; market making still out of scope

A new report entitled, ‘Enhancing the resilience of the US Treasury Market’, has outlined the steps taken by US authorities to support what it...

Staying the course: Outlook for 2018

By Boon Peng Ooi, chief investment officer for fixed income, at Eastspring Investments.

Over the past two years, a “strategy” of “tactically” trading risk has...

Santander, Ramirez & Co. and Mischler Financial Group join DirectBooks

DirectBooks has had Santander, Ramirez & Co. and Mischler Financial Group join its bond issuance platform.

The three additions bring the total number of underwriters...

Wave Labs launches Systematic Investment Application for building systematic credit strategies

Execution management system (EMS) provider, Wave Labs, is launching its Systematic Investment Application (SIA), a new modular system for developing systematic strategies in the...

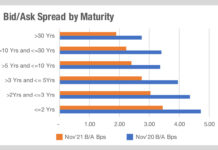

The impact of trading long-dated bonds

Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However,...

JP Morgan cleaned up in Q4 2023 fixed income trading

JP Morgan’s fixed income markets revenue for fourth quarter 2023 were US$4 billion, up 8% YoY, driven by higher revenue in the securitised products...

This Week from Trader TV: Stuart Lawrence, UBS Asset Management

UBS AM: Markets brace for the tariff volatility, and concerns develop over “irrational optimism”

While markets have been trading at all-time highs, Stuart Lawrence, head...

The Bondcast: Simplifying Hard Currency EM Bond Trading

Hard currency EM bond trading is characterised by fragmented markets, multiple time zones, noisy data and growing trade volumes. Traders need timely insights on...