Utility mooted to reduce data onboarding friction

While data has become more abundant across the fixed income ecosystem, making it useful remains a major challenge.

“Some of our desks manage hundreds of...

SOLVE expands corporate bond pricing services

Market data provider SOLVE has launched SOLVE Px, a predictive pricing tool for high yield (HY) and investment grade (IG) corporate bonds.

This tool will...

Bloomberg wins over AB and Capital Group with BVAL

AllianceBernstein (AB) and Capital Group have both selected Bloomberg's evaluated pricing service (BVAL) to benchmark and corroborate end-of-day values for US fixed income portfolio...

Oscar Kressner joins Millennium

Oscar Kressner has joined alternative asset manager Millennium Management Global Investment, as a portfolio manager covering global macro investing. Millennium, which has US$56 billion...

Bloomberg expands dataset on Chinese green bonds

Bloomberg has made the list of Chinese outstanding green bonds aligned with the China-EU Common Ground Taxonomy (CGT) available to Bloomberg Terminal users.

This new...

Exclusive: FENICS Invitations closes

Multiple market sources have confirmed that Fenics Invitations has closed.

The execution service, run by interdealer broker BGC Partners, was intended to provide an all-day...

New flexible data offerings – Eugene Grinberg

Eugene Grinberg, Solve Advisors Co-Founder and CEO, tells The DESK how the firm’s acquisition of Advantage Data and Best Credit Data will support better decision-making...

IMTC launches new, streamlined platform

Fixed income technology specialist, IMTC, has launched a new and improved platform designed to enable fixed income investment managers to improve the accuracy and...

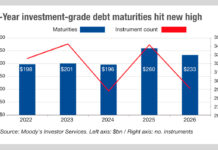

Trouble ahead for traders as number of issued bonds climbs

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given...

Did UBS/CS deal terms just revalue the entire AT1 bond market?

Buy-side trading desks say they are looking at the risk of contagion across financials, following the takeover of troubled Credit Suisse by UBS, for...

MarketAxess launches centralised marketplace with integrated rates trading

Electronic bond market operator, MarketAxess, has launched a centralised fixed income trading marketplace integrating rates trading capabilities within the MarketAxess trading system.

MarketAxess acquired government...

Glimpse Markets adds Exoé, announces payment-for-data model

Buy-side led data sharing utility, Glimpse Markets, has announced that outsourced trading provider, Exoé has joined its network for data sharing across corporate bonds...