FILS USA 2023: Fed has lost investors’ confidence in guidance

The Federal Reserve’s constant mistakes on forward guidance have lost the confidence of some buy-side firms in its ability to predict outlooks.

Speaking at...

Chaucer: Cost of insurance against defaults on sovereign debt jumps by 102%

The cost of insuring against sovereign debt defaults has increased by an average of 102% over the past year, according to research by global...

FIX Trading Community releases guidelines on commission unbundling

By Flora McFarlane.

A new report has set out practices to follow for pre- and post-trade representation of commission steps across all asset classes.

With under...

Subscriber

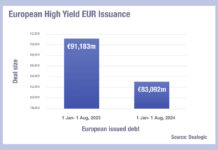

The Atlantic divide over high yield – is private credit biting?

Issuance of USD versus Euro high yield debt shows a significant split, based on Dealogic data, with US markets in 2024 issuing more than...

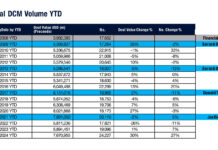

The election effect: Issuance in an election year

Looking at Dealogic data for debt issuance over the past four year tenures of US presidents, it is notable how much the macro picture,...

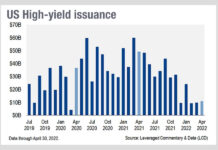

How does the collapse of refinancing affect bond trading?

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in...

Coalition Greenwich: 0% impact of ESG on bond trade execution – but is there...

According to new research from Coalition Greenwich, 0% of US-based buy-side bond traders report that environmental, social and governance (ESG) impacted their choice of...

Rules & Ratings: Ratings agencies spar in private ratings legitimacy debacle

KBRA has hit back at Fitch Ratings’ claims that private credit ratings are inaccurate, stating that the agency has damaged its reputation and integrity...

Swinburne: Traders should beware of radical change in Europe

Brexit will mean that politics will take precedent over principal, when setting policy in Europe, warned Kay Swinburne MEP, speaking at the Fixed Income...

FILS 2021: Next steps to automating the bond market

Data analysis, interoperability and flexibility are the top priorities for automating the bond markets, delegates at the 2021 Fixed Income Leaders Summit (FILS) in...

RBC Capital Markets joins DirectBooks

DirectBooks, the capital markets consortium founded to improve the bond issuance process has seen RBC Capital Markets join its platform as a member.

At present...

Bond market growth slumped in 2018

By Pia Hecher.

Intercontinental Exchange (ICE) Data Indices, the information provider, has reported that the total outstanding debt across global bond markets only grew by...