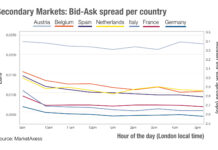

Chart of the week: Trading into Europe

Following our analysis of when to trade into US markets, we examine spreads for European rates markets across the day. For overseas traders working...

Women in finance: A fresh start

Roxane Sanguinetti, head of strategy at GHCO talks to Lynn Strongin Dodds about fintechs, ETFs and culture

Working at a start-up can be an adventurous...

Broadridge preempts trader demands with BondGPT update

Broadridge has updated BondGPT to anticipate user queries and provide market data and insights based on their progression through the investment and trading workflow.

Through...

Coalition Greenwich’s deep dive into fixed income TCA

A report by analyst firm Coalition Greenwich has set out the tough but potentially rewarding path for increased adoption of transaction cost analysis in...

The ‘venue’ question raised by ESMA’s new order execution consultation

The European Securities and Markets Authority (ESMA) is consulting on the development of technical standards (RTS) specifying the criteria for establishing and assessing the...

Bloomberg boosts Australian bond pricing

Bloomberg has expanded its Australian bond pricing services as the market continues to grow.

Australia is the third largest global securitised products market outside of...

Trumid names Jason Quinn as Global Head of Sales

Trumid names Jason Quinn as Global Head of Sales as company continues to expand its trading footprint and to lead firm's commercial direction, including product...

Government & municipal bonds | Investor paradox | Dan Barnes

SWIMMING WITH GOVERNMENTS.

Government agencies are issuers, rival investors, market regulators and controllers of interest rates; how do asset managers handle them? Dan Barnes writes.

Central...

The Agency Broker Hub: An Italian story

The Italian Treasury has implemented a flexible and diversified funding policy to manage the amount of Italian public debt. Here Laura Maridati, Digital Markets...

Viewpoint : The importance of the market maker : Igor Burlakov

Better execution through sell-side innovation

Igor Burlakov, head of Capital Markets at Sova Capital sees the impact of lower rates and reduced volatility impacting trading...

‘Whatsapp’ fines for banks hit US$1.8 billion

US market regulators have collectively fined 15 broker-dealers, one affiliated investment adviser, plus the swap dealer and futures commission merchant (FCM) affiliates of 11...

InvestCloud names new CIO

InvestCloud, a global wealth management software provider, has named James Young its new chief information officer (CIO).

Young will be responsible for the company’s technology...