Portfolio trading is booming in liquidity crisis

Ongoing market volatility has led to a spike in popularity of portfolio trading according to trading platforms, dealers and buy-side traders. Market operator Tradeweb...

The Agency Broker Hub: How agency brokers are shedding their skin

By Umberto Menconi, head of Digital Markets Structures, Market Hub, Intesa Sanpaolo Group*

The agency broker has always played one of the principal roles on the...

Tradeweb confirms purchase of Australian bond trading platform Yieldbroker

Multi-asset market operator, Tradeweb Markets has entered into a definitive agreement to acquire Yieldbroker, an Australian trading platform for Australian and New Zealand government...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

Bigger / smaller: What sizes are optimal for electronic trading?

Credit trading has been transformed by evolving electronic execution, which has allowed buy-side desks to express investment ideas in to the market using more...

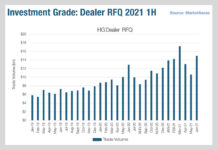

Dealer engagement in multi-dealer platforms is growing

Sell-side firms appear to be increasing their engagement with corporate bond trading platforms. The narrative of increased bilateral trading between dealers and clients...

Origination: S&P prices major senior note issuance

S&P Global has priced a total US$10 billion in senior notes.

The offering is split into US$600 million 4.250% senior notes due 15 January 2031,...

EXCLUSIVE: abrdn’s automation journey sees no-touch jump

Louise Drummond, global head of investment execution at abrdn, discusses the firm’s path towards workflow automation – an achievement that has been almost a...

Primary markets: Give me some credit: Outlook for bond issuance in 2023

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

Smaller proportion of US Treasuries e-traded than previously estimated

Levels of e-trading in US treasuries in dealer-to-dealer (D2D) and dealer-to-client (D2C) markets have come into sharper focus thanks to data collected by FINRA...

Fixed income: The unexpected consequences of change

By Mark Goodman, Managing Director, Global Head of Electronic Execution – FX, Rates, Credit & Futures at UBS Investment Bank.

Our age’s fascination with technology...

Tradeweb in discussions to acquire Australian bond trading platform Yieldbroker

Tradeweb Markets, multi-asset market operator has said, “Tradeweb is in advanced discussions to acquire Yieldbroker, a leading Australian government bond and interest rate derivatives...