MeTheMoneyShow – Episode Six

Dan Barnes, editorial director of Markets Media Europe and editor of The DESK, speaks to Lynn Strongin Dodds, editor of Best Execution about three...

ION announces LatentZero OMS connection to Trumid

ION Markets, has connected its LatentZero order management system (OMS) to Trumid, the fixed income electronic trading platform. The link adds connectivity to ION...

Video interview with Rhian Ravenscroft

Rhian Ravenscroft, Senior Legal Counsel at MarketAxess is asked about her race to the top by Markets Media's, senior writer Shanny Basar.

European Women in Finance...

The gaps that AI can close in credit markets

Artificial intelligence is being applied to bridge and unite information in bond trading. Liquidity is notoriously gappy in credit markets, and market data naturally...

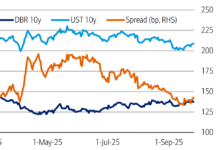

Investor demand: ECB has market pricing govies as if investors favour US over EU...

Market pricing since 21 May reads as if investors prefer US duration over euro-area duration: 10-year US Treasuries (UST) have rallied by 42 basis...

ICE rolls out suite of European equity indices

Market and infrastructure operator, Intercontinental Exchange (ICE), has launched around 600 equity indices covering the qualifying, listed security universe across 16 selected European countries,...

ESMA consults on potential changes to CSDR penalty regime

The European Securities and Markets Authority (ESMA) has published a consultation paper seeking input on amendments to the Central Securities Depositories Regulation (CSDR) penalty...

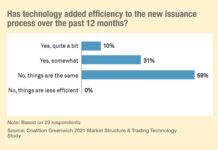

New issuance process unchanged for 59% of traders despite electronification

New research from analyst firm, Coalition Greenwich, has found that 59% of traders are still waiting to see an improvement in the new issue...

FILS Day One: Traders give lessons on dealing desk versatility

The Fixed Income Leaders’ Summit launched with practical lessons from buy-side traders on how to handle the very different trading conditions seen in 2020,...

MarketAxess muni offerings incorporated into Investortools Dealer Network

Fixed-income electronic trading platform MarketAxess has expanded its municipal bond integration with the Investortools’ platform, the latest phase of its Financial Information eXchange (FIX)...

Exclusive: BMO Capital Markets, Blaylock Van, and American Veterans Group join DirectBooks

DirectBooks has had BMO Capital Markets, Blaylock Van, and American Veterans Group join its bond issuance platform.

These recent additions increase the total number...

Liquidnet integrates bondIT’s AI-driven credit research

Block trading specialist and trade information provider, Liquidnet, and bondIT, supplier of AI driven investment technology, are partnering to integrate bondIT’s Scorable Credit Analytics...