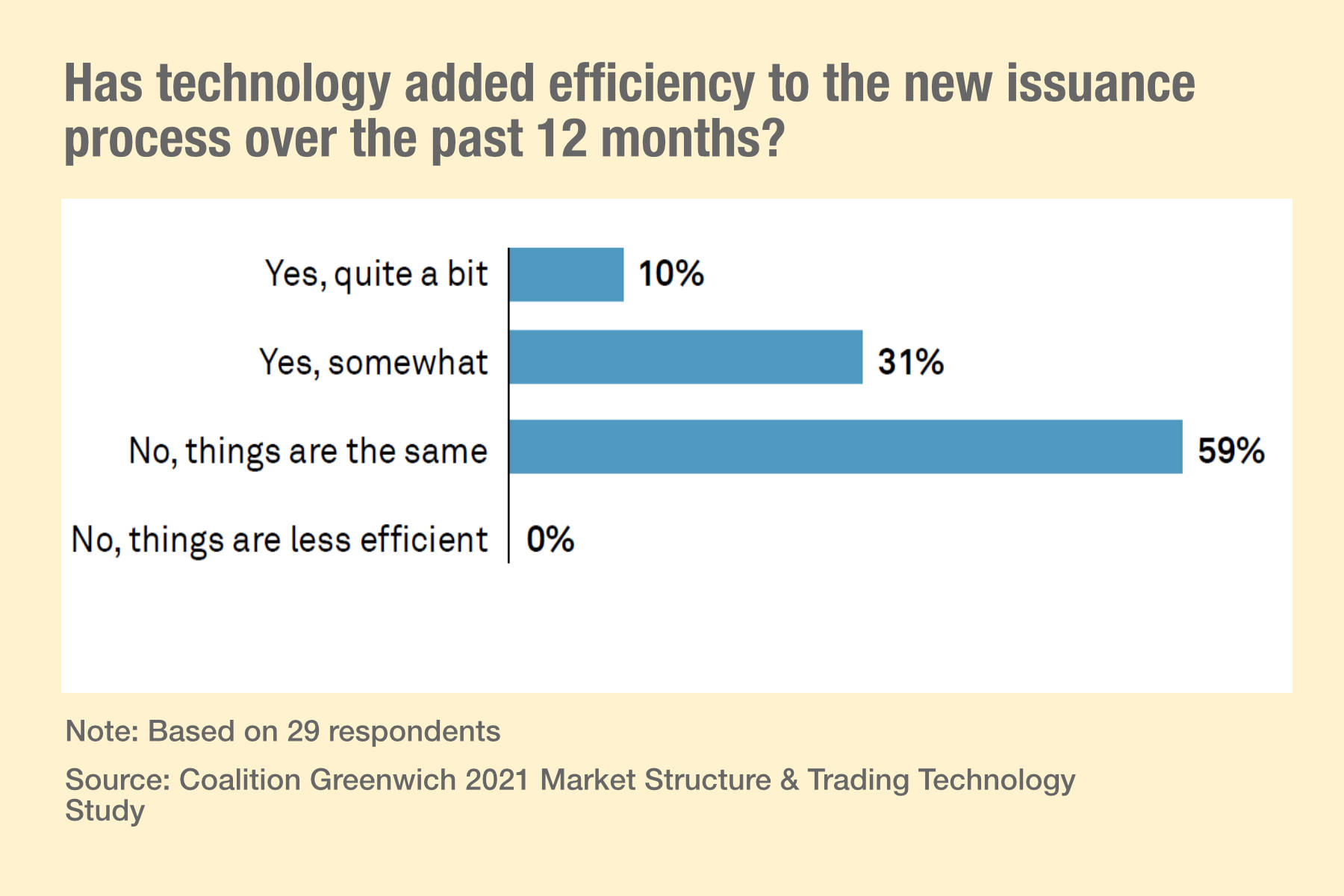

New research from analyst firm, Coalition Greenwich, has found that 59% of traders are still waiting to see an improvement in the new issue process for bonds, despite the launch of many new systems and upgrades to existing platforms over the past two years.

While 10% reported a significant change, and 31% reported a small change, that suggests the many new issue solutions that have launched / continued to grow ove the past two years are still struggling to make an impact for the majority of traders.

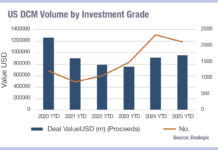

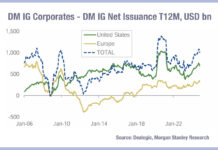

Given the reduced volumes of new issues in high yield across Europe and the US, this may not be such a priority in 2022 – so will progress stall?

For buy-side traders, and many sell-side sales desks, managing new issues is a processing, rather than a performance additive, problem. Traders add little value, and there is simply a balancing act to get the allocation of issued securities / getting the right price for the profile of the bonds.

The research found that in new issue platforms, ‘The ability to express interest/send instructions’ was the most desired feature based on its changing prioritisation over the past two years. Integration with order management systems closely followed. While fewer traders (27%) wanted integration with a trading venue, that represented the greatest leap since the previous year (from 0%).

When issuance is high, this makes trading in the secondary markets very tough indeed as it sucks up time to manage other orders to which traders can add value.

Now that liquidity is drying up in secondary markets and primary markets are also seeing reduced activity, it is possible that pressure upon primary market platforms to evolve will reduce, due to lower client demand. As a result, incremental change is more likely in 2022 unless traders are bale to maintain the pressure to drive reform and efficiency.

©Markets Media Europe 2025