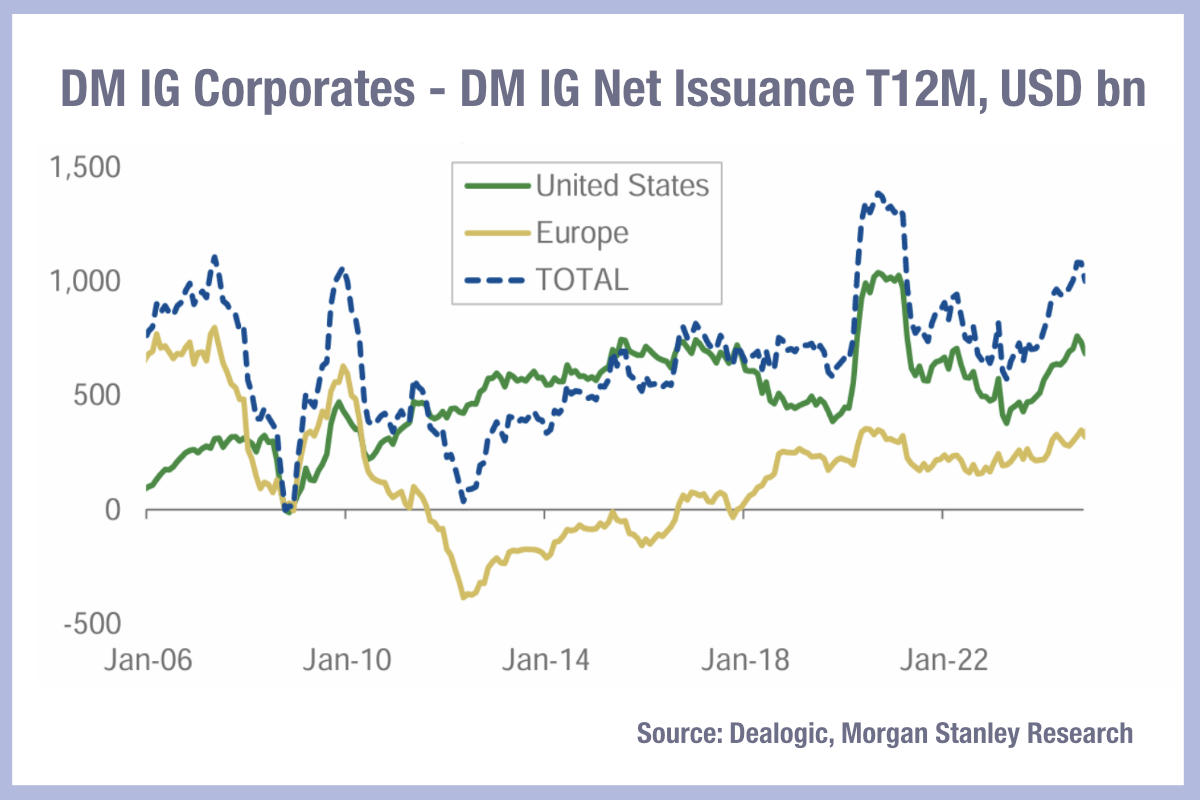

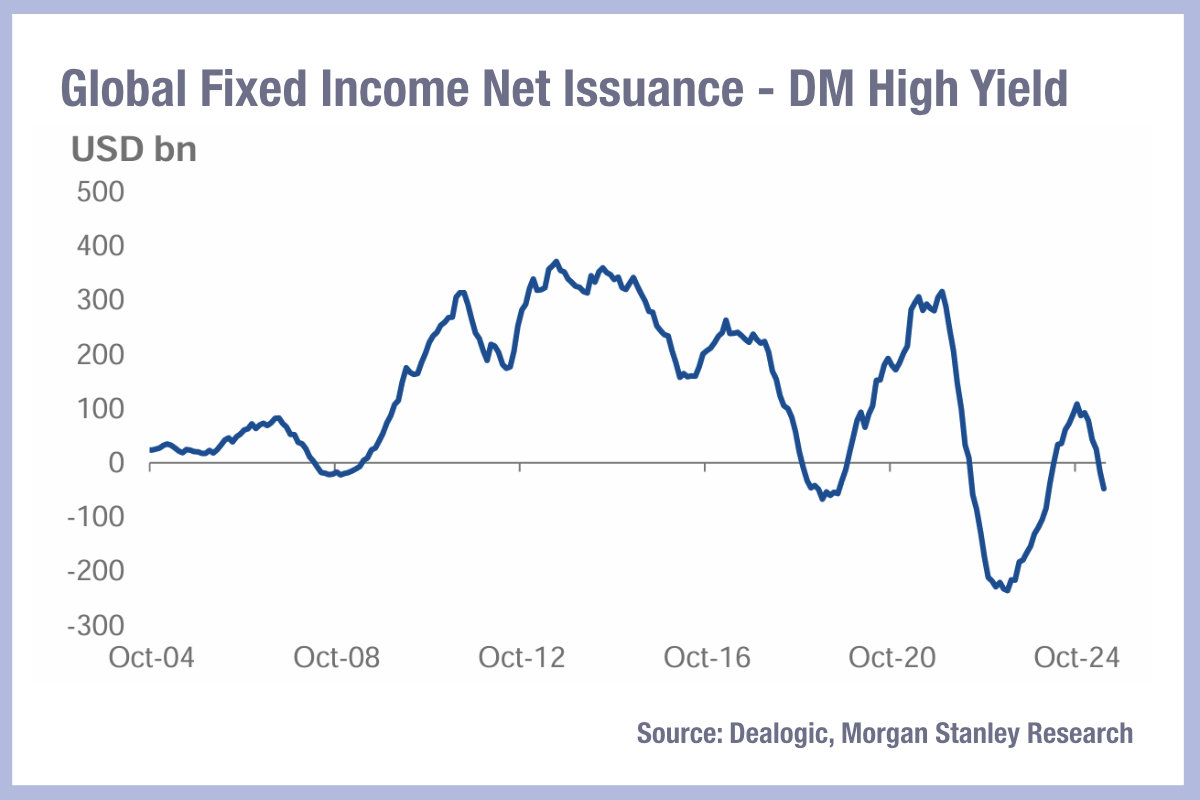

Gross credit issuance has fallen in developed markets, according to data from Dealogic and Morgan Stanley, across investment grade (IG) and high yield (HY).

DM gross issuance was 12% lower in IG and 28% lower in HY than the 2024 run rate in April, respectively.

Dealogic data indicates that year-to-date deal numbers are down 11% globally and value is down 6% globally. Deal numbers were down most significantly in the European, Middle East and Africa (EMEA) region where they fell by 17% YTD, while deal value was down most significantly in Asia Pacific (APAC) where it fell 10%.

The impact of this decline in business is likely to be followed by a drop-off in secondary market liquidity, given the level of activity that follow a new issue.

Although market uncertainty around global trade is having a negative effect on credit conditions and issuance appetite, the uncertainty in rates outlooks will also be a key factor here, with disagreement over the likelihood of interest rate changes at central banks, including the Fed.

“Although trade talks remain the driving force for markets, sentiment has also been bolstered by the fact that the Fed meeting passed without alarming investors,” wrote Mark Haefele, chief investment officer, UBS Global Wealth Management, in May 2025. “While Powell said that the Fed was in no rush to cut rates, he stressed that this was because the US economy was still in good shape and that the Fed could move swiftly if needed. Our view is that the Fed will start cutting rates in September as evidence mounts of moderating growth and cooling labor market conditions. Our base case is for 100 basis points of further easing.”

©Markets Media Europe 2025