By Edward Perks (Executive Vice President, Chief Investment Officer, Franklin Templeton Multi-Asset Solutions).

In 2018, rising inflation, higher US interest rates and escalating trade tensions have led to concerns about global economic growth and bouts of equity-market volatility. However, Ed Perks, CIO of Franklin Templeton Multi-Asset Solutions, says corporate credit has been a bright spot for fixed income investors. He gives his outlook for the global economy and explains why he still sees value in select high-yield bonds.

As we head into the latter half of 2018, rising inflation and higher US interest rates―against a backdrop of intensifying global trade tensions and widening tariffs―have begun to pose challenges for many developed and emerging-market economies. As a result, many investors could be wondering about our outlook for global growth and its influence on our investment decisions.

Despite these issues, and weakness in a number of confidence indicators, we think the balance of economic news and data remains supportive. We continue to expect positive global economic growth led by a US economy that appears to be in relatively good health.

Midsummer Outlook for Inflation and US Interest Rates

We do not see inflation as a meaningful factor just yet in the United States. What we see with inflation today is a return to normalisation after the global financial crisis.

Our view is that inflation will continue to tick up, but the increase is apt to be very gradual. The primary forces that have kept inflation muted—globalisation and technological innovation—are still in place and should continue to have a restraining influence, in our view.

In the United States, labour-market strength has continued while generating what we believe are manageable increases in labour costs as job openings have exceeded the number of unemployed. We think increasing costs, particularly wages, are likely to be only a modest drag on profit margins.

What’s more, we think US corporate profits―supported by business spending and expanding manufacturing activity―are likely to be strong and hold the potential to be conducive to further interest-rate hikes.

Will Trade Disputes Affect Global Growth?

We think it is important to acknowledge that fears of protectionism are not new and have been with us in many parts of the world during the current economic expansion. At this stage, the likelihood of a full-scale retaliatory trade war appears at least partially contained as world leaders continue to seek productive solutions, but the escalating conflicts that we saw in the spring and early summer remain a risk. On the whole, we do not see international trade coming to a standstill or the global economy toppling into recession in the near term.

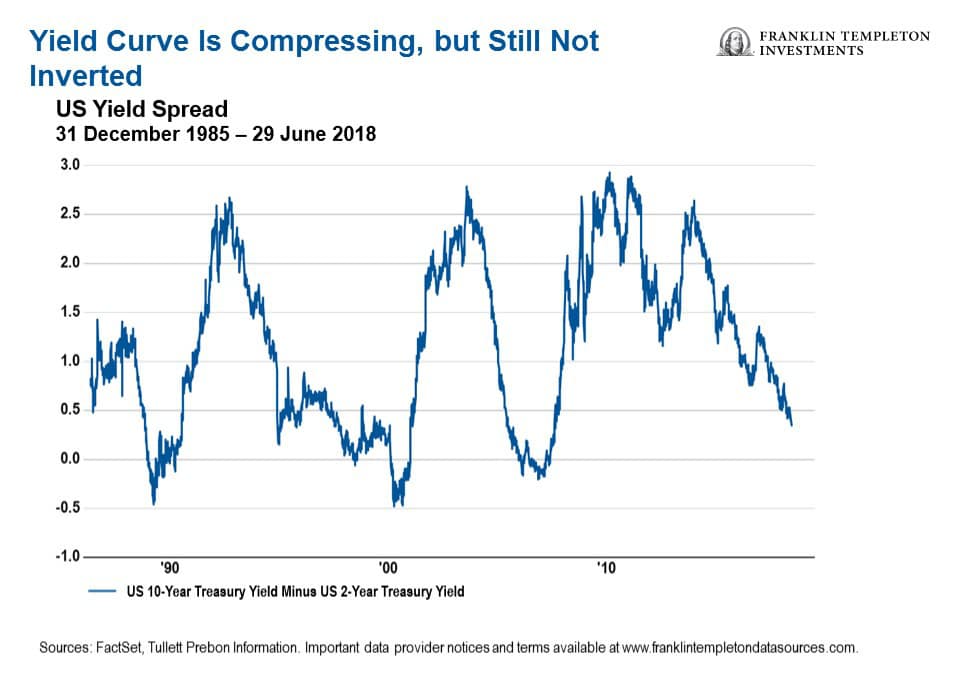

We hold this view even as the US yield curve, which is a graphical representation of the difference between interest rates on short-term and long-term US government bonds, has been flattening as shorter-term rates have been rising more quickly than longer-term rates. Although we think it is perfectly normal for yields to rise along with stocks, this metric is closely watched due to its apparent predictive value—every recession in the past 60 years has been preceded by the yield curve inverting, or falling below zero.

As the chart below shows, the gap between two-year and 10-year Treasury notes narrowed to roughly 30 basis points in June, and the yield curve compressed to a level not seen since 2007.

Implications for Fixed Income Investments

Corporate credit has been resilient, even in the face of rising US interest rates. Although we have seen volatility pickup this year in equities, credit has performed pretty well, in particular below-investment-grade corporate bonds (those rated below BBB- by independent credit rating agency Standard & Poor’s).

Certainly the length of the economic cycle―now entering its tenth year of expansion in the United States alone―factors into our decision-making. Should this elongated economic cycle start to show some typical end-of-cycle signs, such as slowing earnings momentum or inverted yield curves, we would expect to see related shifts in our portfolio positioning.

In the fixed income space, we have been focusing a bit more on the shorter end of the yield curve, and hold a generally positive bias towards corporate credit because we continue to think the fundamental backdrop remains very supportive.

The yield on the two-year US Treasury note has risen from 1.89% to 2.52% in the first half of 2018. Furthermore, the gap between yields on high-yield bonds and those on US government debt has narrowed this year, even as the spread between highly rated debt and Treasuries has widened.

Within some of our income-oriented portfolios, as certain high-yield corporate bonds and equities appeared to reach our estimates of full valuation, we have established positions in short-duration US Treasuries in the one- to five-year range, given the recent increase in yields in those categories. Importantly, we believe this will provide flexibility during periods of potential volatility in the second half of 2018.

We are seeing firsthand how thriving corporate profitability has supported select corporate bonds at the fundamental level, seemingly in defiance of more aggressive US Federal Reserve policy and political and geopolitical challenges. Many such securities are closely geared towards the strength of the US economy.

Distress in the high-yield corporate bond market remains idiosyncratic, not widespread, across sectors. Moreover, based on our analysis, speculative-grade debt defaults have been trending down while being eclipsed by an uptrend in corporate bond analysts’ credit-quality upgrades, and the near-term credit outlook amongst high-yield companies is generally benign.

Looking Ahead

As in 2017, our bias so far this year has been towards shorter- and intermediate-term maturities. In general, companies continue to be highly focused on any of their upcoming maturities, and so those shorter maturities may be able to perform better even in a period of volatility.

That said, we continue to look for signs of default risk before it is priced into the corporate bond market. These warning signs would potentially surface from a deterioration in fundamentals, including the issuer’s total leverage (debt-to-cash-flow ratio) and interest coverage measured by annual cash flow generation to annual interest expense.

As investors in corporate bonds and bank loans, we want to be very particular about the types of companies that we are lending to or purchasing the debt of, and we also want to be highly targeted about where in their capital structure we are positioning ourselves.

Industry Viewpoints are a place for thought-provoking views and debate. These views are not necessarily shared by The DESK or its publisher.

For more comment from Franklin Templeton CLICK HERE.

©Markets Media Europe 2025