Tag: Bloomberg

Bloomberg launches US Treasury dealer algos to expand buy-side access to...

Bloomberg announces the completion of the first trade using its newly launched US Treasury (UST) Dealer Algos.

This first-to-market solution provides buy-side clients with broader...

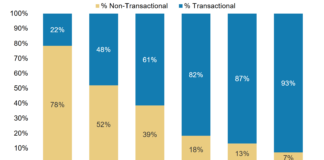

Bloomberg research: Automated trading boosts both productivity and performance

Automated trading solutions have gone from being a tough sell to a requisite as firms seek to improve productivity.

However, the impact on performance...

Bloomberg drops RUNZ forwarding over information leakage fears

On 10 September 2024 Bloomberg started automatically blocking the forwarding of RUNZ-formatted messages.

A RUNZ formatted message is an email message composed on the Bloomberg...

Rules & Ratings: Understanding gaps between credit risk data and credit...

While credit ratings underline investor confidence and evaluation of debt products, credit risk data can potentially offer a more nuanced source of information for...

Dealers face crunch on platform trading costs

As bid-ask spreads tighten and fees rise, dealers question making markets in credit.

It does not take a quant to understand that tighter bid-ask spreads...

The Fixed Income Leaders Summit: Debating a decade of change

The focused event delivered a communication hub that has supported the buy and sell side as they navigated market transformation.

“In 2014, this event was...

CME: Rising open interest in credit futures signals confidence in corporates

CME Group has seen a rapid rise in Open Interest (OI) for Bloomberg Credit Futures.

In the past two months, the number of these futures...

China Minsheng Bank taps Bloomberg for sell-side solutions suite

China Minsheng, a Chinese commercial bank, has adopted Bloomberg’s sell-side execution management solution ETOMS, and expanded its use of Trade Order Management Solutions (TOMS)...

Investors flock to credit futures amid credit spread concerns

CME Group has reported a sharp increase in credit futures contracts, noting nine consecutive days of increases in active, unsettled contracts.

The US credit futures...

BayernInvest taps Bloomberg for integrated asset management workflow offering

BayernInvest, a German asset manager with approximately €88 billion assets under control, has adopted an integrated suite of Bloomberg solutions to support its front-to-back...