Tag: credit

Simpler bond liquidity assessments diverge on either side of the Channel

British and European authorities are actively aiming to simplify bond liquidity and transparency regimes, but divergent reporting deferral rules for rates and credit, as...

Insights & Analysis: Technology upends traditional credit trading liquidity patterns, Barclays...

In a recent research note Zornitsa Todorova, head of FICC research at Barclays contends that with over half of IG volumes now electronic, systematic...

Brett Chappell starts at TransFICC in independent advisory role

TransFICC has engaged Brett Chappell as an independent fixed income expert for market structure and thought leadership.

He previously spent two years at BankInvest as...

RBC joins ICE Clear Credit

RBC Capital Markets has joined Intercontinental Exchange (ICE) Clear Credit as a futures commission merchant (FCM). RBC becomes the first FCM participant at ICE...

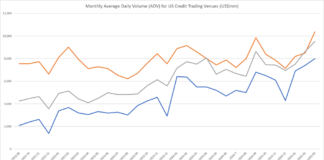

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

Insights & Analysis: Pricing freedom

The street is waiting anxiously for the announcement and impact of all the trade tariffs to be announced on 'Liberation Day’; the term the...

CanDeal launches live pricing for Canadian corporate bonds

CanDeal has announced the launch of Corporate Matrix Pricing on its Evolution platform, providing intraday pricing for Canadian corporate bonds alongside integrated trading capabilities....

ISDA expands transparency exercise to European CDS

The International Swaps and Derivatives Association (ISDA) has expanded its SwapsInfo derivatives database to include European credit default swaps (CDS) trading activity, enhancing transparency...

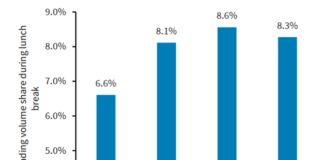

Tradeweb takes electronic credit trading lead, for second time

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and...

Barclays: European portfolio trading to hit 18% in three years

Portfolio trading share in Europe’s investment grade market could get closer to that of the US from its current 10–12% level in volume to...