Tag: Investment grade (IG)

Eurex, Cboe end 2025 with record credit futures OI despite December...

In December, CME’s US dollar credit futures traded US$400 million in average daily volume ( ADV) with US$541 million in open interest (OI), Cboe’s iBoxx iShares suite printed US$148 million ADV and...

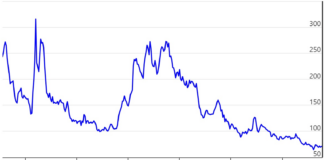

‘Alternative’ rating agencies’ early Greece upgrades led Moodys and S&P

Greek spreads over German debt have tightened from 270 basis points to 70 basis points since mid 2022. Non-traditional rating agencies like Scope ratings...

Don’t Panic: How French credit has proven market Zen

The resignation of the French Prime Minister, Sébastien Lecornu, on 6 October came after less than a month in office. Being the third prime...

Trumid’s US electronic credit volume in sight of MarketAxess’ and Tradeweb’s

US electronic credit activity accelerated in September as primary-market heavy issuance spilled into secondary trading. On FINRA’s TRACE tape, combined US investment-grade and high-yield...

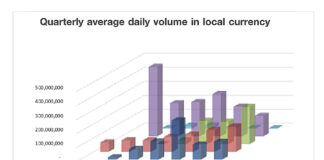

CME’s credit futures volumes quadruple YoY

Q3 2025 average daily volume (ADV) on CME’s dollar denominated credit futures reached US$292.3m, up 390% from Q3 2024, with average open interest (OI)...

MarketAxess reclaims electronic credit trading crown in quiet market

US electronic credit activity eased sharply in August. On FINRA’s TRACE tape, combined US investment-grade (IG) and high-yield (HY) average daily volume (ADV) came...

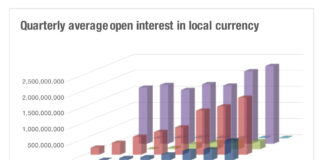

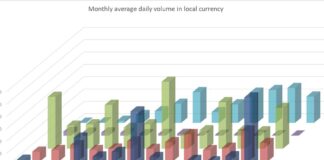

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Barclays: European portfolio trading to hit 18% in three years

Portfolio trading share in Europe’s investment grade market could get closer to that of the US from its current 10–12% level in volume to...

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...