Tag: S&P Global

How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

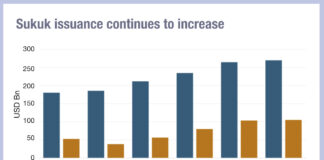

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth...

S&P sells off business arms to STG

Private equity firm STG has completed its acquisition of S&P Global’s Enterprise Data Management (EDM) business and its portfolio management, order management and compliance...

Origination: European private credit fundraising overtakes US

Europe’s appetite for private credit is on the rise, according to S&P Global's 2026 outlook, with 9M 2025 fundraising by funds in the region...

Electronic bond trading expanding to match MENA markets rapid growth

Bond markets in the Middle East & North Africa (MENA) region have seen primary and secondary activity surging in 2025, reflecting individual country’s sovereign...

Origination: S&P prices major senior note issuance

S&P Global has priced a total US$10 billion in senior notes.

The offering is split into US$600 million 4.250% senior notes due 15 January 2031,...

S&P Global acquires With Intelligence

S&P Global has acquired private markets data, insights and analytics firm With Intelligence in a US$1.8 billion deal.

The company announced in October that it...

S&P Global offers private credit risk management service

S&P Global has released a compliance management solution for credit risk management, designed for private credit and collateralised loan obligation (CLO) managers.

The launch coincides...

Ratings & Analysis: S&P Global taps Snowflake connectivity for private markets...

Private markets investors are now able to input data from S&P Global’s iLEVEL portfolio monitoring platform directly into their Snowflake environments.

Investors will be able...

Ratings & Analysis: First Brands Group issuer ratings plunge

Autopart supplier First Brands Group has plummeted in credit agency ratings, declaring bankruptcy in the US.

Fitch dropped the company from B to CCC last...