Tag: S&P Global

Rules & Ratings: S&P Global brings standard identifiers to private credit

S&P Global has expanded its LoanX IDs (LXIDs) to provide private credit identifiers.

The LXIDs identify instruments across counterparties and datasets, enabling them to be...

S&P Global launches credit risk research chatbot

S&P Global has launched a chatbot on its S&P Capital IQ Pro market intelligence platform in an effort to simplify the credit risk research...

S&P and CME offload OSTTRA to KKR

S&P Global and CME Group have agreed to sell their post-trade solutions business OSTTRA to global investment firm KKR.

The US$3.1 billion enterprise value deal...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

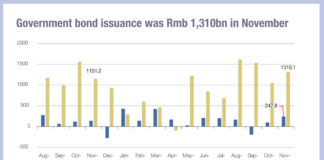

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

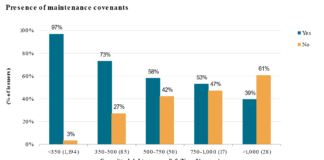

Origination: Switching between private and public markets

The use of private versus public borrowing by corporations has changed during 2024, based on falling funding costs in public and the capacity to...

The Fixed Income Leaders Summit: Debating a decade of change

The focused event delivered a communication hub that has supported the buy and sell side as they navigated market transformation.

“In 2014, this event was...

S&P Global Ratings: Fallen angels remain costly despite tightening spreads

Brenden Kugle and Patrick Drury Byrne of S&P Global Ratings, have published a new paper assessing the borrowing costs for ‘fallen angels’, corporates whose...

Primary ignition – at both ends

Politics are being sidelined in the battle for efficiency in primary markets for buyers and for issuers

The top operational priority for buy-side traders in...

Helen Burgess joins S&P Global

S&P Global has appointed Helen Burgess as sales director for the market intelligence division.

Burgess has close to three decades of industry experience, most recently...