Tag: Trumid

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

Collins leaves Trumid for MarketAxess

Gav Collins has swapped Trumid for MarketAxess, being named head of the transformation office.

Based in London, Collins will work on the firm’s long-term strategic...

MarketAxess outperforms competition in October through slower month

US electronic credit trading slowed down in October. FINRA’s TRACE tape recorded combined US investment-grade (IG) and high-yield (HY) average daily volume (ADV) at...

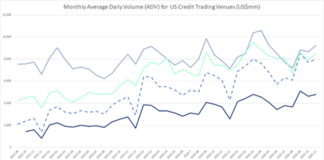

Trumid’s US electronic credit volume in sight of MarketAxess’ and Tradeweb’s

US electronic credit activity accelerated in September as primary-market heavy issuance spilled into secondary trading. On FINRA’s TRACE tape, combined US investment-grade and high-yield...

MarketAxess reclaims electronic credit trading crown in quiet market

US electronic credit activity eased sharply in August. On FINRA’s TRACE tape, combined US investment-grade (IG) and high-yield (HY) average daily volume (ADV) came...

US electronic platforms’ credit activity plateaued in July

Tradeweb now narrowly leads over MarketAxess in fully electronic US IG+HY trading, Trumid said it continues to gain market share.

Average daily volume reported on...

US electronic platforms’ credit activity cools further in

Average daily volume reported on TRACE for US investment grade (IG) and high yield (HY) dropped a further 9% month-on-month (MoM) in June to...

US electronic credit trading slows down in May

Average daily TRACE volume for US investment grade (IG) and high yield (HY) corporates slipped 10.8% from April to US$52.8 billion, according to MarketAxess...

MarketAxess holds US credit trading high ground in April volatility

A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber